The Kenyan government has sought to overturn a Court of Appeal decision that invalidated the Finance Act 2023, warning that a reversal to the Finance Act 2022 could result in a staggering KES 211 billion revenue loss and jeopardize the country’s credit ratings.

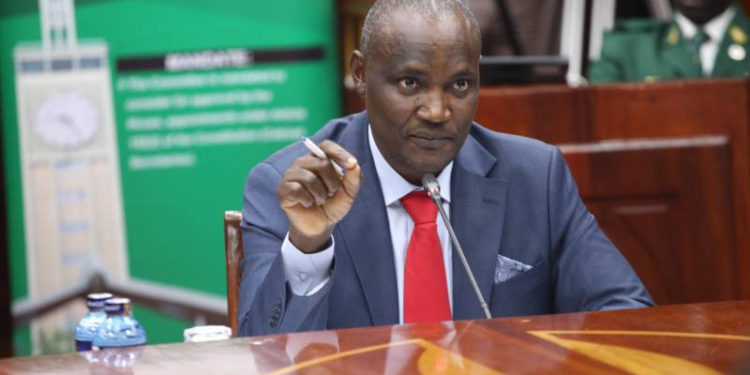

Represented by Senior Counsel Prof. Githu Muigai, the government argued that the invalidation of the 2023 Act would severely impact its financial stability and ability to meet debt obligations.

The National Assembly, the Office of the Attorney General, the Treasury, and the Kenya Revenue Authority (KRA) are appealing the July 31 ruling by the Appellate Court, which nullified the Finance Act 2023. Prof. Muigai, representing the Attorney General and the Treasury, emphasized that reverting to the previous Finance Act would not only affect government revenue but also harm Kenya’s international credit rating, impacting the country’s borrowing capacity.

“This would be a very serious issue because it would in effect also hamper the Government’s ability to raise revenue through borrowing,” Prof. Muigai stated during the Supreme Court hearing. His remarks highlighted the potential fiscal turmoil and the difficulty in funding government programs if the appellate decision stands.

In contrast, Lawyer Issa Mansuor, representing the National Assembly and its Speaker, argued that the Finance Act 2023 had undergone adequate public participation. Mansuor contended that the Appellate Court’s finding that the Act lacked proper consultation was unfounded. “Nowhere did the National Assembly dismiss any submission, even where the same propositions were made by different individuals or institutions,” Mansuor asserted, adding that the House standing orders permit amendments to bills post-public participation without requiring additional rounds of consultation.

The appeal, presented before a seven-judge bench led by Chief Justice Martha Koome, is pivotal as the Finance Act 2023 is crucial for current government operations following the collapse of the Finance Bill 2024 earlier this year. The hearing, which also includes Justices Philomena Mwilu, Mohammed Ibrahim, Smokin Wanjala, Njoki Ndung’u, and William Ouko, continues with significant implications for Kenya’s fiscal health and governance.

Respondents to the appeal, including Busia Senator Okiya Omutata and various civil society organizations, argue that some amendments to the Finance Act 2023 were introduced without sufficient public participation. Senator Omutata has urged the court to uphold the appellate decision, asserting that the Act’s procedural flaws undermine its legitimacy.