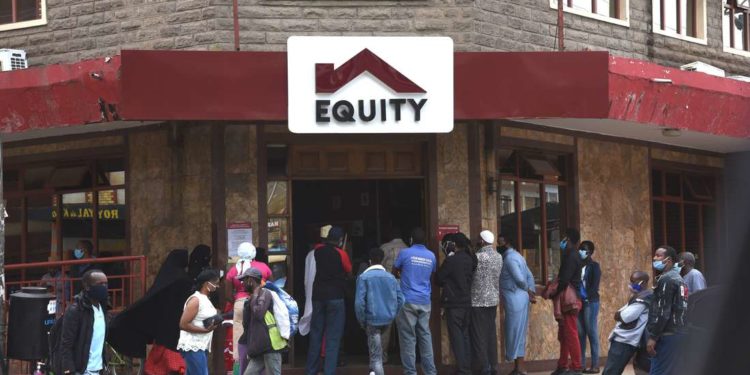

Equity Bank, the most profitable bank in Kenya, has become the first lending company to adjust its lending rates in line with the new Central Bank lending rate benchmark. The Bank has announced an increase in the Equity Bank Reference Rate (EBRR) to 14.69%, up from the existing 12.5%, effective Monday, July 10th. The above increase in lending rates will increase the cost of servicing loans on both new and existing loans that are Kenya Shilling denominated. Some borrowers will pay a higher interest rate based on their individual credit risk profile. This will see some borrowers pay more than 21.0% in the cost of servicing their borrowing. The above increase in borrowing costs is a result of the 100-bps increase in the central bank rate from 9.5% to 10.5% on June 26.

Read more: Equity Bank Announces 46.1 Billion Net Profit for FY’2022

Equity Bank recorded a decrease in the cost of funds to 2.9% in Q1’2023 from 4.0% in Q12022, which highlights a lower cost of obtaining operational funds like deposits and loans for the bank. Likewise, the bank recorded a net yield on loans of 10.9% and a loan book of Kshs 448.9 billion in Q1’2023.

Read more: Central Bank Approves Acquisition Of Assets Of Spire Bank By Equity Bank

Banks are continually shifting towards risk-based pricing for loans where borrowers have access to loans at different rates, in contrast to the traditional uniform cost of loans. This is dependent on the individual’s credit risk score. Borrowers with a low credit score are at higher risk of obtaining loans at higher interest margins since it indicates a higher risk of defaulting on the loan. As a result, the new route means a high cost of obtaining credit for some borrowers, while the banks are able to lend more and cover a larger crowd of borrowers. However, the higher returns from risk-based lending serve as a cushion for lenders against the increased rate of loan defaults.

Read more: Equity Group Announces Plans to Acquire a Stake in a Rwandan Bank

As a result, the Central Bank of Kenya reported a 16-year high non-performing loan ratio of 14.9% in May, up from 13.3% recorded in December 2022. The total non-performing loans increased by Kshs 82.9 billion in four months to Kshs 570.6 billion at the end of April from Kshs 487.7 billion in December 2022. This indicates increased loan defaults in the country, attributable to the less favourable business environment in the country currently.

Email your news TIPS to editor@thesharpdaily.com