By Cytonn Report

As highlighted in our 2022 Annual Markets Outlook, elections generally pose the risk of destabilizing an economy should the resultant period be chaotic and unstable politically. This leads to a ripple effect whereby production decreases in the country due to decreased business activities. This also leads to low investor confidence in the country and leads to negative capital net flows.

Investor sentiments are generally expected to be poorer with the more apprehensive investors and the risk-averse are expected to sell off their investment holdings while moderate risk-appetite investors hold off on new investments.

Historical Effects Of Elections

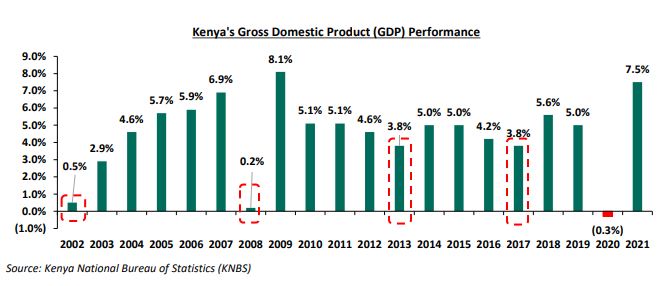

In terms of economic growth, elections have had a negative effect in the past given the disruptions that come along with the cycle. The chart below shows the GDP growth over the last four electioneering periods:

In the past twenty years, save for 2020, the lowest GDP growth was recorded in 2008 following the political instability that was occasioned by the post-election crisis. In the other three periods, the GDP declined in the election cycles and increased in the preceding years reflecting the economic disruptions that are brought about by the elections. As such, we expect the 2022 electioneering period to weigh down the projected average growth of 5.1%.

Read: Ugandans Happier Than Kenyans – Report

In the equities market, the market valuation for listed companies has remained independent of the effects of elections in the past years. In the months surrounding the March 2013 election the NASI P/E ratio was on the rise, attributable to a general rise in stock prices during the period in majority of the countries globally, which saw NASI gain by 72.4% in the period January 2012 and December 2013. This was an indication that the market’s confidence during the period was not affected by the electioneering period.

Similarly, for the 2017 general elections, the NASI P/E was on an upward trajectory partly due to declining earnings for the banking sector stocks owing to the tough operating environment as a result of the interest rate capping and prolonged political uncertainty in the country after the first round elections were nullified. The environment also affected the market sentiments shortly after the first round elections, as the NASI P/E started declining.

In the real estate market, the average investor returns softened by 11.3% points to 14.5% in 2017, from 25.8% realized in 2016, according to the Cytonn Annual Markets Review 2017 due to the shaky general elections effects that resulted to a declined demand in properties.

Read: Kenya Gazettes ICT Inclusivity Products And Services For Persons With Disabilities

However, the Kenyan real estate sector has been witnessing tremendous growth and developments over the past years have recorded a 6.7% growth in 2021, a 2.6% points increase from 4.1% in 2020, according to the Kenya National Bureau of Statistics Economic Survey 2022.

Despite this, there are challenges that continue to hinder the performance of the sector like financial constraints, and, oversupply in select Real Estate sectors such the commercial office and retail sectors. Also, being that this is an election year, there exist looming qualms that are expected to slightly weigh down the optimum performance and activities of the property sector.

In the current business environment, rates in the fixed income market have been on an upward trajectory partly on the back of the heightened perceived risk occasioned by the emergence of new COVID-19 variants and the upcoming 2022 elections. On the other hand, the Kenyan equities market has been on a downward trajectory in 2022 having declined by 22.3% for NASI on a year-to-date basis.

The decline is mainly attributable to losses recorded by large-cap stocks such as Safaricom, of 30.7%, Equity and KCB which have both declined by 16.6% as well as DTB-K and ABSA which have declined by 16.0% and 14.5%, respectively. The real estate sector has registered increased activities so far in 2022 and remains an attractive investment class.

Read: Electricity Demand In Kenya Hits A New High Of 2,051MW

Outlook – Expected Effect of the 2022 Elections

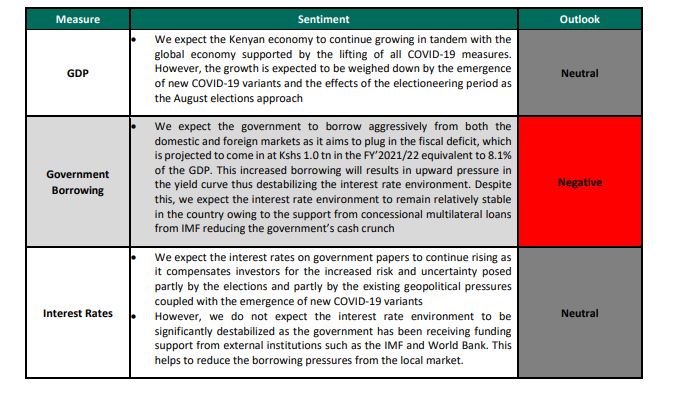

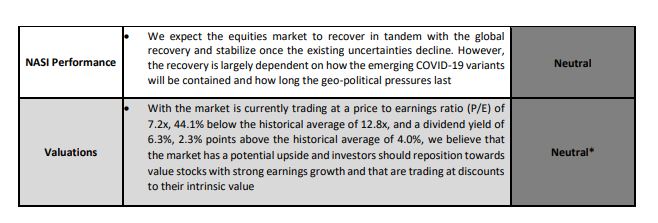

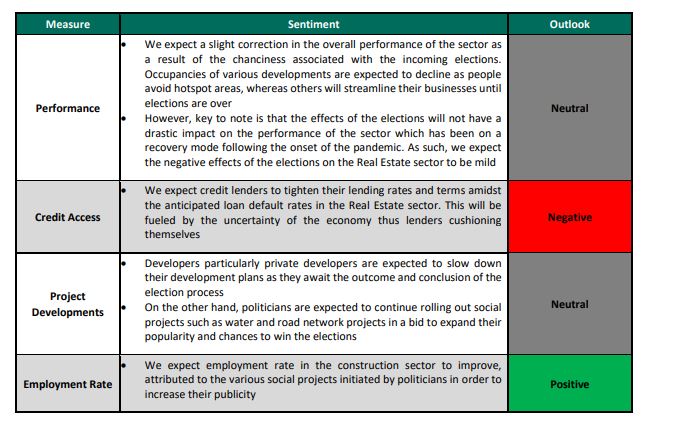

The tables below summarizes the expected performance of the key market determinants in the fixed income, equities and real estate markets;

a.) Fixed Income

b.) Equities

c.) Real Estate Markets

In conclusion, economic development and investments performance is largely depended on continuity and a stable macro-economic environment which significantly determine the investors’ sentiments. In our view, a peaceful transition will be key in maintaining the current trend of economic recovery given that the economy is still recovering from the adverse effects of COVID-19. As such, we maintain a general ‘NEUTRAL’ outlook on the effects of elections on the investment environment as we expect the government to fulfil its commitment to a politically stable business environment during and after elections. However, we are of the view that the investment markets are driven by other external factors such as existing geo-political pressures, emergence of new COVID-19 variants, rising inflation rates as well as increasing yields in developed countries as opposed to the effects of the general elections.

Read: Why Nairobi Presents The Best Investment Opportunities – Report