In recent years, cross-border mobile money transfers have significantly transformed the economic landscape across Africa, particularly influencing regional trade. This change is especially evident in East Africa, where countries like Kenya have become global leaders in mobile money adoption, promoting seamless cross-border transactions and fostering regional economic integration.

Mobile money platforms, such as Kenya’s M-Pesa, have expanded their services beyond national borders, enabling individuals and businesses to transfer funds quickly, securely, and affordably. For example, partnerships between Safaricom (Kenya) and MTN (Uganda) facilitate effortless money transfers across the Kenya-Uganda border. These services have bridged financial gaps, especially for small and medium-sized enterprises (SMEs) that dominate regional trade.

One notable impact of cross-border mobile money transfers is the reduction of transaction costs. Traditionally, cross-border money transfers required using banks or money transfer agencies, which often charged high fees and involved lengthy processes. Mobile money has not only lowered these costs but also accelerated transactions, allowing traders to settle payments in real-time. For instance, a trader in Kenya can now pay a supplier in Tanzania within minutes, leading to faster delivery of goods and improved trade efficiency.

Additionally, mobile money has enhanced financial inclusion, bringing previously unbanked populations into the formal economy. This inclusion has empowered small-scale traders, such as those in Kenya’s bustling Gikomba Market, to expand their reach across borders. Farmers also benefit by accessing wider markets for their produce, fostering economic growth in rural areas.

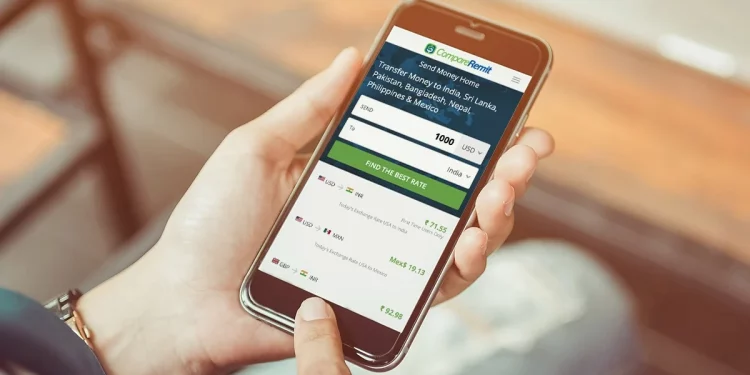

Additionally, mobile money facilitates currency conversion in real-time, eliminating the need for physical foreign exchange transactions. For instance, platforms like WorldRemit and M-Pesa Global have streamlined currency exchange for traders, enhancing convenience and reducing risks associated with carrying cash across borders.

However, challenges remain. Regulatory disparities between countries can hinder the seamless flow of mobile money services. For example, inconsistencies in taxation and transaction limits across East African nations create hurdles for users. Addressing these issues through harmonized policies would further boost regional trade.

Cross-border mobile money transfers have emerged as a game-changer in regional trade, particularly in East Africa. By enabling cost-effective, fast, and secure transactions, they have strengthened trade networks, enhanced financial inclusion, and fostered economic integration. As mobile technology continues to evolve, it holds the promise of transforming regional trade and unlocking the full potential of Africa’s interconnected economies.