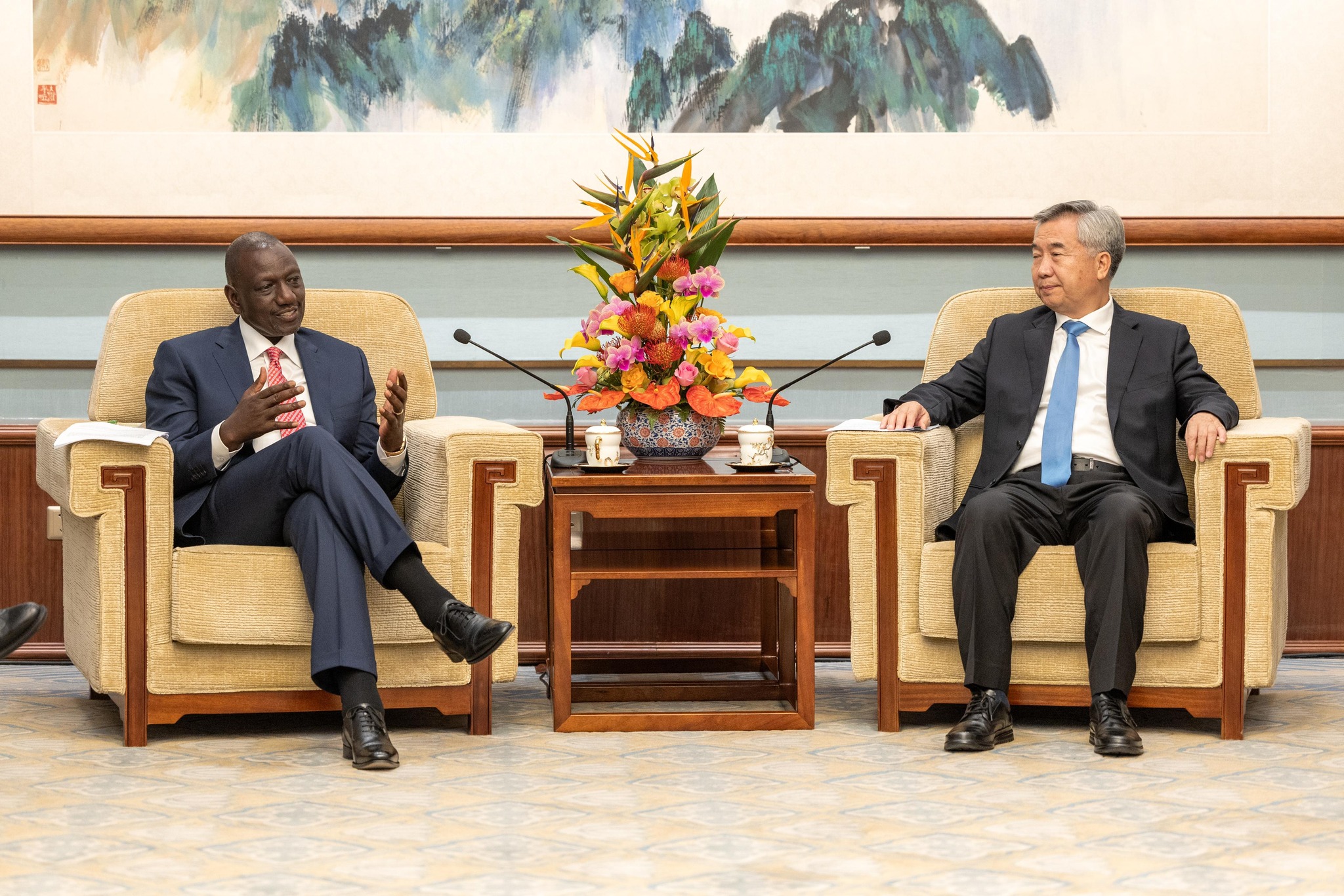

President William Ruto left Nairobi for China on October 14, 2023, with State House announcing that the trip aims to underscore the robust bilateral relations between Kenya and China and highlight Kenya’s active participation in the 3rd Belt and Road Initiative (BRI). President Ruto’s visit follows renewed efforts by the government to strengthen trade and economic ties with the economic powerhouse in the Far East. However, the International Monetary Fund (IMF) is cautioning African nations about the potential for a regional economic downturn and the ripple effects of China’s slowing economy.

China-Kenya Relations The People’s Republic of China and the Republic of Kenya have maintained a long-standing relationship. Diplomatic ties were established on December 14, 1963, making China the fourth country to officially recognize Kenya’s independence. Bilateral relations deepened during the administration of Daniel Arap Moi in 1978.

Today, China-Kenya relations remain highly productive. In May 2017, during President Uhuru Kenyatta’s visit to the Great Hall of the People, President Xi Jinping and Former President Uhuru Kenyatta upgraded China-Kenya relations to the Comprehensive Strategic Cooperative Partnership (CSCP). President Xi Jinping stressed the importance of approaching bilateral relations strategically and from a long-term perspective, maintaining high-level exchanges, and offering mutual support on issues related to core interests and major concerns.

China is Kenya’s largest trading partner, with bilateral trade increasing at a Compounded Annual Growth Rate (CAGR) of 20.9 percent, reaching USD 8.3 billion in 2022, up from USD 186.4 million in 2002. Recent data shows that China’s exports to Kenya have grown at an annualized rate of 16.7 percent, reaching USD 5.81 billion in 2021, compared to USD 104.0 million in 1995. Conversely, Kenya’s exports to China have increased at an annualized rate of 21.8 percent, reaching USD 202.0 million in 2021, up from USD 1.2 million in 1995.

The Slowdown of China’s Economy China, the world’s second-largest economy with a population exceeding 1.4 billion, is grappling with several challenges, including slow economic growth, high youth unemployment, and a disarrayed property market. China’s economic growth began decelerating in the early 2010s due to various factors, such as a slowdown in the real estate sector, demographic shifts from an aging population, and recent external uncertainties like trade tensions, geo-economic fragmentation, and the COVID-19 pandemic.

Unlike Western consumers, Chinese citizens largely had to fend for themselves during the COVID-19 pandemic, and the anticipated surge in spending upon reopening did not materialize. Additionally, softening demand for Chinese exports and rising living costs among key trading partners have impacted China’s economic landscape. With a significant portion of household wealth tied to real estate, a slowdown in this sector is affecting other segments of the economy.

Household consumption as a percentage of Gross Domestic Product (GDP) was already low before COVID, contributing to an economic imbalance reliant on debt-fueled investments. Weak domestic demand has led to subdued private sector investment and a slide into deflation in July. If deflation persists, it could exacerbate the economic slowdown and debt challenges.

China’s GDP growth has been gradually declining over the last decade, falling from 7.9 percent in 2012 to 3.0 percent in 2022. Weak economic data has raised concerns that China may struggle to achieve its 2023 economic growth target of around 5.0 percent without increased government spending.

Its Impact on Kenya Despite years of expansion, Chinese investment and lending in Sub-Saharan Africa have retrenched since 2017. At the 2021 China-Africa Cooperation Forum, China announced a reduction in financial support to Africa, decreasing from USD 60.0 billion to USD 40.0 billion over three years.

Official Chinese loan disbursements to Sub-Saharan Africa have sharply declined, now representing about one-eighth of their peak value at 1.2 percent of the region’s GDP in 2016. In 2022, Chinese loans to Kenya decreased for the first time in 15 years. Treasury data shows that China’s total lending to Kenya dropped to USD 6.8 billion in June 2022 from USD 7.1 billion in 2021 and USD 3.0 billion in 2016.

Given the deep economic ties, a further slowdown in China’s growth in the medium to long term is likely to negatively affect economic activity in Kenya. In a recent publication titled “At a Crossroads: Sub-Saharan Africa’s Economic Relations with China,” the IMF observes that negative spillovers would primarily arise from trade links, including a deceleration in export volumes and declines in commodity prices.

As Kenya’s primary export market, a slowdown in China’s economy could lead to a decline in Kenyan exports, affecting key sectors such as agriculture and manufacturing. This decline could widen Kenya’s trade deficit and further weaken the Kenyan currency, which has already reached a record high of KES 150.3 against the dollar. Furthermore, China’s economic slowdown could impact Kenya’s economic growth, with the IMF suggesting that non-oil-exporting countries could experience an average growth loss of 0.2 percentage points.

What Kenya Should Do to Offset This Having previously benefited from China’s economic growth, Kenya must adapt to China’s slowdown and declining economic engagements. Navigating these new challenges will require building resilience and implementing structural reforms that promote alternative sources of growth through:

- Increasing regional trade integration: Kenya can capitalize on this by expanding its import and export markets. While the African Continental Free Trade Area (AfCFTA) holds significant promise, its successful implementation will require substantial reductions in trade barriers and improvements in the overall trade environment, including the removal of non-tariff barriers.

- Promoting economic diversification: Diversification is crucial for establishing new trade relationships beyond China and mitigating the effects of changing global trade patterns.

- Reducing external dependence: Efforts should be made to boost domestic revenue mobilization, reducing reliance on external revenue and financing while enhancing spending efficiency and generating alternative, sustainable sources of funding for development priorities.

Kenya’s ability to adapt, innovate, and diversify will be pivotal in mitigating the impact of China’s economic slowdown and steering the nation toward a more robust and resilient future.