The Central Bank of Kenya (CBK) has gazetted new rules for digital lenders, that will see the entities operate under its mercy as from September 17, 2022.

The rules will see the digital lenders barred from accessing the customer’s phone book or contacts list and other phone records, which they use to coerce defaulters to pay their loans.

The Digital Credit Providers regulations, 2022 will require all digital lenders to apply for licences from the banking regulator before September.

“The Regulations are now operational, all previously unregulated DCPs are required to apply to CBK for a license within six months of the publication of the Regulations, i.e., by September 17, 2022, or cease operations,” CBK said on Monday.

Read: Ugandans Happier Than Kenyans – Report

The Digital Credit Providers (DCPs) will also not be allowed to submit negative credit information of a customer or any other person to a Credit Reference Bureau where the outstanding amount relating to the credit information does not exceed Ksh1,000.

“The regulations provide for inter alia the licensing, governance, and lending practices of DCPs. They also provide for consumer protection, credit information sharing, and outline the Anti-Money Laundering and Combating the Financing of Terrorism (AML/CFT) obligations of DCPs,” said CBK Governor Dr Patrick Njoroge.

Read: Safaricom Eyes More Through Tech Solutions For Enterprises

A DCP shall not invite or collect deposits in any form, including the taking of cash collateral as security for loans.

They have been barred from using threats, violence or other means to harm the debtors, their reputation or property if they do not settle their loans.

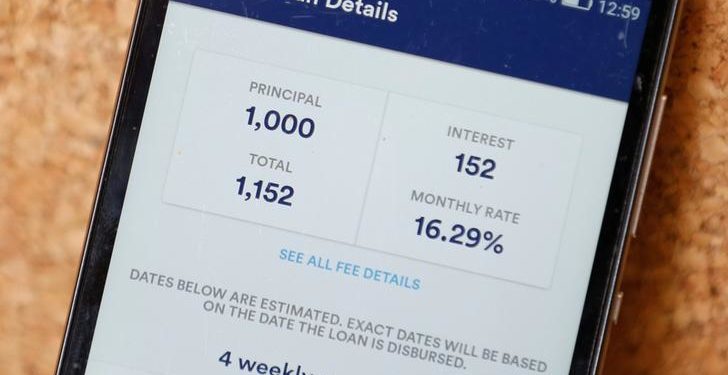

The lenders will from September apply to CBK for approval of interest rates on their loans.

Read: Absa Bank Kenya Record Ksh10.9 Bn Profit, Pays Ksh6 Bn In Dividends