The National Treasury has exempted businesses with an annual turnover of less than KES 5 million from issuing electronic tax invoices (eTIMS) generated from the Kenya Revenue Authority’s prescribed system.

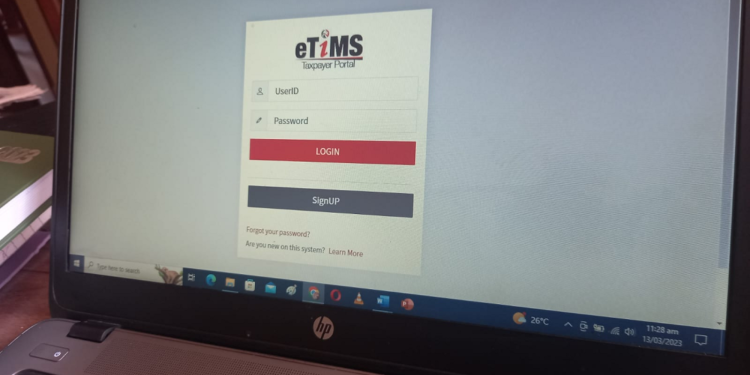

The new Tax Procedures (Electronic Tax Invoice) Regulations 2023, gazetted last week, mandate the use of eTIMS by all businesses in Kenya to enhance tax compliance.

However, Cabinet Secretary for the National Treasury Njuguna Ndung’u said “supplies by a resident person whose annual turnover is less than five million shillings” will be excluded from the requirement.

The regulations also exclude certain transactions like emoluments, imports, and supplies by non-residents from generating eTIMs.

According to the new rules, failure to comply with the regulations or tampering with eTIMS devices could attract penalties specified in the Tax Procedures Act, 2015.

The commissioner will also have powers to retire an eTIMS device if a business closes down or transitions away from the technology.

The rollout of eTIMS started in January 2022 on a voluntary basis but faced some resistance, especially from small taxpayers. This saw the government push the deadline to 2023.

With the new regulations taking effect, experts project a marked improvement in tax compliance as business transactions become more transparent.

The regulations require that the features and capabilities of eTIMS devices conform to specifications outlined by KRA to enhance standardisation, integration and data transmission.