The Blockchain Association of Kenya (BAK) has submitted the Virtual Asset Service Provider (VASP) bill to the National Assembly, advocating for the establishment of a regulatory sandbox. The proposed sandbox aims to test and regulate cryptocurrency players before granting them licenses to operate.

The BAK was tasked to draft a framework to govern the cryptocurrency industry because the lack of a framework has led to the mushrooming of dubious cryptocurrency scams that have defrauded Kenyans of millions.

In the draft Virtual Asset Service Provider (VASP) bill presented to the National Assembly, the Blockchain Association of Kenya (BAK) is advocating for digital asset businesses to operate as commercial entities within the country.

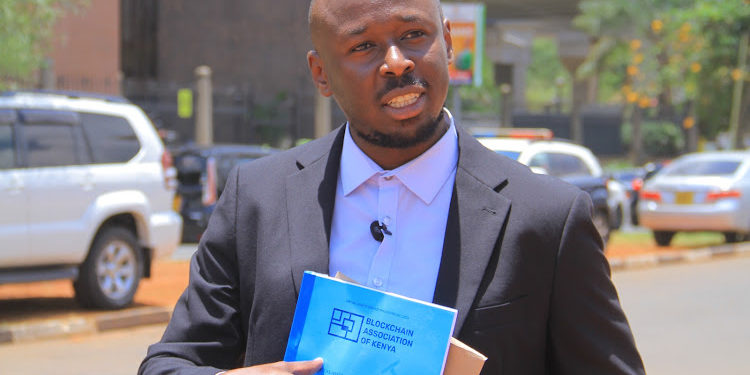

Michael Kimani, Chair of the Blockchain Association of Kenya, explains that the bill includes a licensing structure for crypto firms to register in Kenya, as well as a sandbox mechanism allowing businesses to operate under a trial phase before receiving approval.

“Virtual currency businesses have been struggling to get into the CMA sand box because of the lack of a framework. What this draft bill is proposing is a joint regulatory sandbox that will involve CBK, CMA and all other regulators where they can all take part jointly in approving some of these business coming into the sandbox,” said Kimani.

He added that the proposed Bill tackles the concerns of the industry, consumers, and regulators by suggesting a licensing structure, consumer protection framework, measures for Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF), and the establishment of a regulatory sandbox.

The Cabinet Secretary will officially announce the members of the Sandbox, which will include a representative from the Capital Markets Authority, Central Bank of Kenya, Financial Reporting Centre, and a representative designated by the current Cabinet Secretary responsible for information and communication technology affairs.

The body will also incorporate a representative of the Nairobi International Financial Centre, the Law Society of Kenya, the Competition Authority of Kenya and a representative of the Kenya Revenue Authority.

While digital asset regulation has been a global challenge, developed countries like the United States, Hong Kong, and Singapore have set precedents for reining in the industry.

In Africa, countries such as Nigeria and South Africa have already implemented regulations to manage the cryptocurrency sector, addressing concerns about capital flight and criminal activities like money laundering.

In Africa, countries like Nigeria and South Africa have already put in place regulations to manage the industry which is seen as enabling capital flight and providing avenues for criminal activity such as money laundering.

The draft VASP Bill will put Kenya on the map as a digital asset hub. If passed, the bill will see an inflow of tax revenues into the coffers of Kenya’s National Treasury.