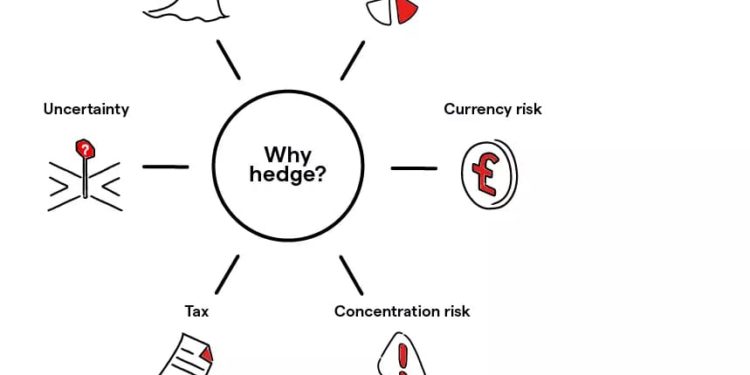

Hedging is often mistaken for caution, yet it is one of the most deliberate forms of action a market participant can take. It is not a reaction to risk, but a redefinition of it. Where most see uncertainty as a hazard, hedging treats it as a lever and a force to shape timing, exposure, and consequence.

To hedge is to acknowledge that certainty is fleeting, but commitment is costly. It is to act without fully deciding, to participate without surrendering judgment. Hedging transforms waiting into agency. Capital does not sit idle; it is poised, conditional, and accountable to both information yet unseen and outcomes yet unrealized.

In markets, hedging is the invisible architecture beneath every confident price. Futures, options and swaps are all scaffolding for the decisions participants are not yet ready to make. The instruments themselves are neutral, yet collectively they encode a spectrum of belief: the range of plausible outcomes, the width of doubt, the weight of hesitation. Where markets appear stable, hedges are often working tirelessly, preserving optionality while masking indecision as equilibrium.

Corporate behavior mirrors this pattern. Firms lock in costs, secure resources, and distribute exposures—not because they can predict the future, but because they refuse to let ambiguity determine their limits. Hedging becomes a language of control. It signals where tolerance ends and irreversibility begins. It is less a forecast than a boundary condition, less a prediction than a negotiation with the unknown.

The paradox of hedging is that it obscures as it clarifies. By reducing variance, hedges mute signals. Price action becomes muted, balance sheets appear stable, and volatility falls below what intuition expects. Yet in this quiet, profound truths are forming. The degree to which capital is hedged, and the way it is structured, reveals more about belief, fear, and patience than any headline or economic report could.

Hedging is therefore not defensive. It is strategic, temporal, and almost philosophical. It recognizes that most outcomes are unknown in the present, and that time is the only currency capable of resolving uncertainty. The hedger’s skill is not in avoiding loss, but in owning ambiguity, and in translating waiting into leverage.

When hedges are eventually lifted, the market moves with conviction only because it carries the weight of previously contained doubt. The shift is abrupt, disciplined, and sometimes violent, a crystallization of all the choices deferred. Until that moment, hedging remains the silent dominant force: a structured patience that quietly dictates what is possible, permissible, and profitable. (Start your investment journey today with the cytonn MMF, call+2540709101200 or email sales@cytonn.com)