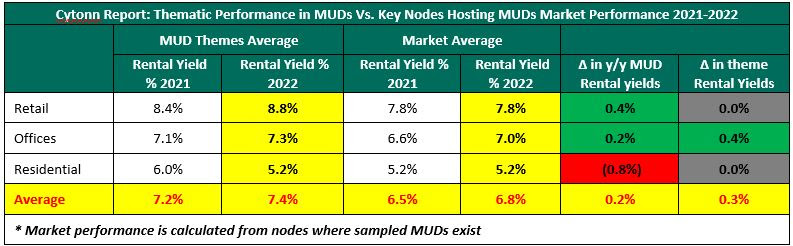

Mixed-Use Developments (MUD) recorded an average rental yield of 7.4% in 2022, 0.6% points higher than the respective single-use themes which recorded an average rental yield of 6.8% in between 2021 and 2022.

Additionally, the MUD performance was a 0.2% points increase in the average rental yield from the 7.2% realized in 2021. This was mainly attributed to their increasing popularity and attractiveness to the high and middle-income earning population hence driving their demand, an improved business environment, and prime locations of the developments.

This is according to the Nairobi Metropolitan Area Mixed-Use Developments (MUDs) Report-2022 by Cytonn Real Estate, the development affiliate of Cytonn Investments. The report analyses the performance of MUDs within the Nairobi Metropolitan Area by tracking the changes in occupancies, rental yields and rental rates. It also outlines the outlook and investment opportunity for MUDs.

The table below shows the performance of single-use and mixed-use development themes between 2021 and 2022;

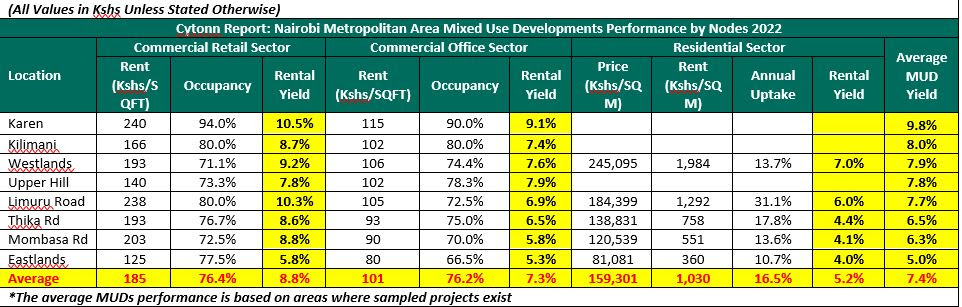

In terms of submarket performance, Karen was the best-performing node with an average MUD rental yield of 9.8%, 2.4% points higher than the market average of 7.4% in 2022, attributed to the presence of prime retail and office spaces fetching higher rents and yields, adequate quality infrastructure supporting investments, and affluent residents with high consumer spending power.

Read: Jubilee Remains The Most Attractive Listed Insurance Company – Report

On the other hand, Eastlands was the worst performing node with the average MUD rental yield coming in at 5.0%, 2.4% points lower than the market average of 7.4%, attributed to low rental rates attracted by developments, inadequate support infrastructure to promote investments, competition from informal sectors especially in the retail theme, and a lower consumer spending power of residents.

The table below shows the performance of Mixed-Use Developments by node in 2022:

Investment opportunity lies in areas such as Karen, Kilimani and Westlands which recorded an average MUD rental yield of 9.8%, 8.0% and 7.9%, respectively, against the market average of other independent Real Estate themes of 7.4%.

Email your news TIPS to editor@thesharpdaily.com