The Growing Push for Financial Access Beyond Urban Centers

A significant shift in Kenya’s banking landscape is being witnessed as financial institutions are urged to expand their footprint beyond urban centers. This transformation is being driven by the recognition that millions of rural residents remain underserved, despite representing substantial economic potential.

Understanding the Current Banking Gap

In regions like Garissa County, where over 1.59 million people reside, only two bank branches have been established. Consequently, most rural households continue to depend on informal savings methods, including cash storage and livestock investments. This reliance on informal mechanisms is not driven by choice but rather by the absence of accessible banking infrastructure.

Moreover, the long-standing concentration of banking services in urban areas has been attributed to factors such as population density, established infrastructure, and higher transaction volumes. However, this approach has left significant economic value untapped across rural Kenya.

Financial Literacy: The Missing Link

Financial literacy has been identified as a critical barrier to banking adoption in underserved areas. Importantly, low literacy rates in rural regions are not caused by an inability to learn. Instead, they result from limited physical access to banking facilities and the confidence that comes through familiarity with financial services.

Furthermore, trust cannot be built through digital platforms alone. Physical bank branches, staffed by trained personnel who can engage with communities, are essential for establishing the foundation upon which digital services can later be adopted. Therefore, the sequence matters: access first, trust second, and growth third.

Strategic Approaches to Rural Expansion

Several strategic initiatives are being implemented by forward-thinking banks. For instance, Diamond Trust Bank’s opening of its 92nd branch in Garissa—only the second in the county—signals a recognition that rural expansion represents long-term market opportunity rather than corporate social responsibility.

Additionally, Islamic finance products are being prioritized in regions where conventional banking has not resonated culturally. This approach demonstrates that financial inclusion must be designed to meet communities where they are, both geographically and culturally.

Economic Impact of Banking Access

When formal banking services are introduced to previously underserved areas, several economic transformations occur. Firstly, savings are mobilized into productive investments rather than remaining idle. Secondly, credit becomes available to small businesses and agricultural enterprises, enabling growth and job creation.

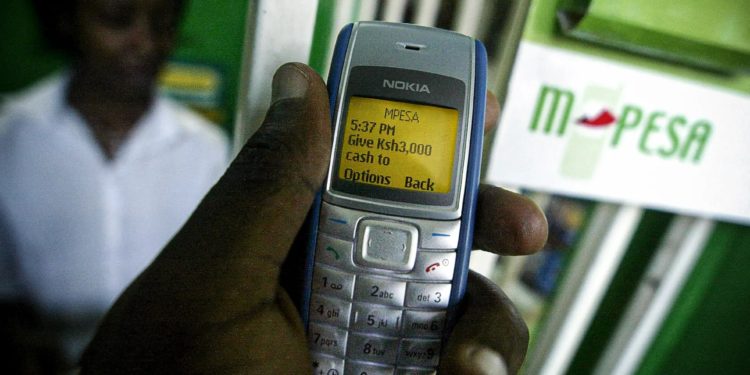

Furthermore, remittances flow more efficiently, reducing transaction costs for families dependent on money sent from urban centers or abroad. Subsequently, digital financial services gain adoption once trust and familiarity with formal banking systems have been established.

The Business Case for Patient Capital

While rural banking expansion requires higher initial investment and typically generates thinner margins, the long-term business case is compelling. Early movers are positioned to build customer loyalty in underserved markets, establish first-mover advantages as rural economies develop, and create infrastructure for future digital service adoption.

Ultimately, this patient approach to capital deployment is being recognized as essential for unlocking regional economic potential. The transformation will not happen overnight, but the structural changes it enables are significant.

Policy and Community Engagement

Successful rural banking expansion requires more than physical infrastructure. It necessitates comprehensive community engagement, financial education programs, and product designs that reflect local economic activities and cultural values.

In conclusion, the expansion of banking services into rural Kenya represents both a market opportunity and a pathway to broader economic inclusion. As more institutions recognize this potential, the gap between urban and rural financial access can progressively be narrowed, creating more equitable economic participation across the country.