Planning for retirement is essential in achieving long-term financial security, and the Cytonn Umbrella Retirement Benefits Scheme (CURBS) is designed to help employees do just that. CURBS is a Defined Contributions Scheme that allows both employers and employees to make regular contributions towards an individual’s retirement savings. Ideal for organizations that lack a retirement plan, CURBS provides a turnkey solution for securing employees’ futures.

One of the key attractions of CURBS is its simplicity and accessibility. Employers need only pass a resolution and sign a Deed of Adherence to join, after which employees can enroll by submitting basic identification documents. Contributions begin at just 2.5% of the employee’s salary, matched equally by the employer, and can be topped up with additional voluntary contributions without any upper limit. The scheme is also approved by RBA to accept and manage NSSF Tier 2 Contributions, ideal for employees looking to maximize their NSSF contributions through a private scheme.

Beyond the discipline of saving, CURBS offers substantial tax advantages. Contributions up to KES 30,000 per month are tax-exempt. Another significant benefit is the free life cover and the amount depends on the member’s contributions at the time of death, and it includes payouts for permanent disability, critical illness, and last expense.

Members can track their savings with regular statements and annual interest distributions. Contributions are invested across various asset classes as guided by the scheme’s Investment Policy Statement (IPS), allowing members to benefit from market-linked returns and economies of scale. The scheme is independently governed and administered by a team of professionals, including Goal Advisory as trustee, Enwealth Financial Services as administrator, and SBM Bank as custodian.

In case of job exit, members can withdraw up to 50.0% of their savings or transfer the entire amount to another registered scheme. This flexibility ensures members remain in control of their retirement journey, even when they change employers.

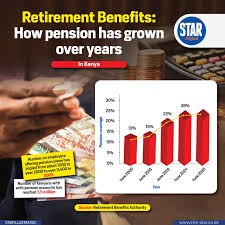

With its competitive returns, having declared returns of 18.8% for 2024, robust governance, and added benefits like tax relief and life cover, CURBS offers a comprehensive and reliable retirement savings solution. Whether you’re an employer looking to support your team or an employee aiming to build a stable future, CURBS is the smart choice for long-term financial well-being.