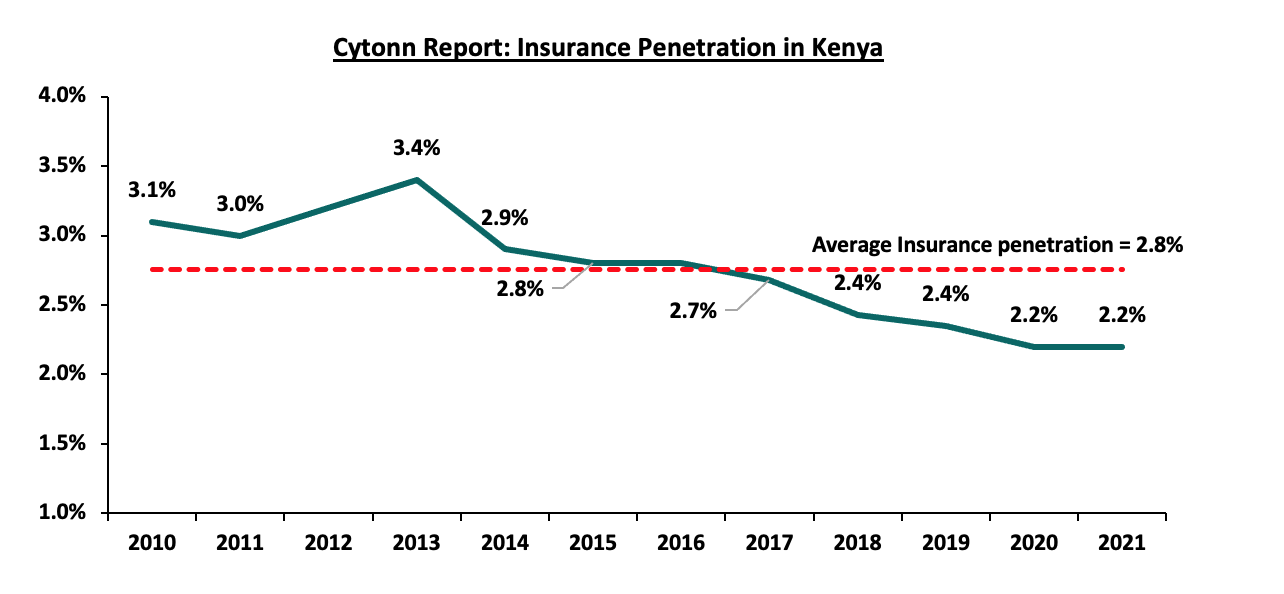

Insurance uptake in Kenya remains low compared to other key economies with the insurance penetration coming in at 2.2% as at 2021, according to the Central Bank of Kenya’s Kenya Financial Sector Stability Report 2022.

The low penetration rate, which is below the global average of 7.0%, is attributable to the fact that insurance uptake is still seen as a luxury and mostly taken when it is necessary or a regulatory requirement. Key to note, Insurance penetration remained unchanged at 2.2% in 2021, same as what was recorded in 2020, despite the economic recovery that saw an improved business environment highlighting the low insurance uptake in the country.

Source: CBK Financial Stability Reports

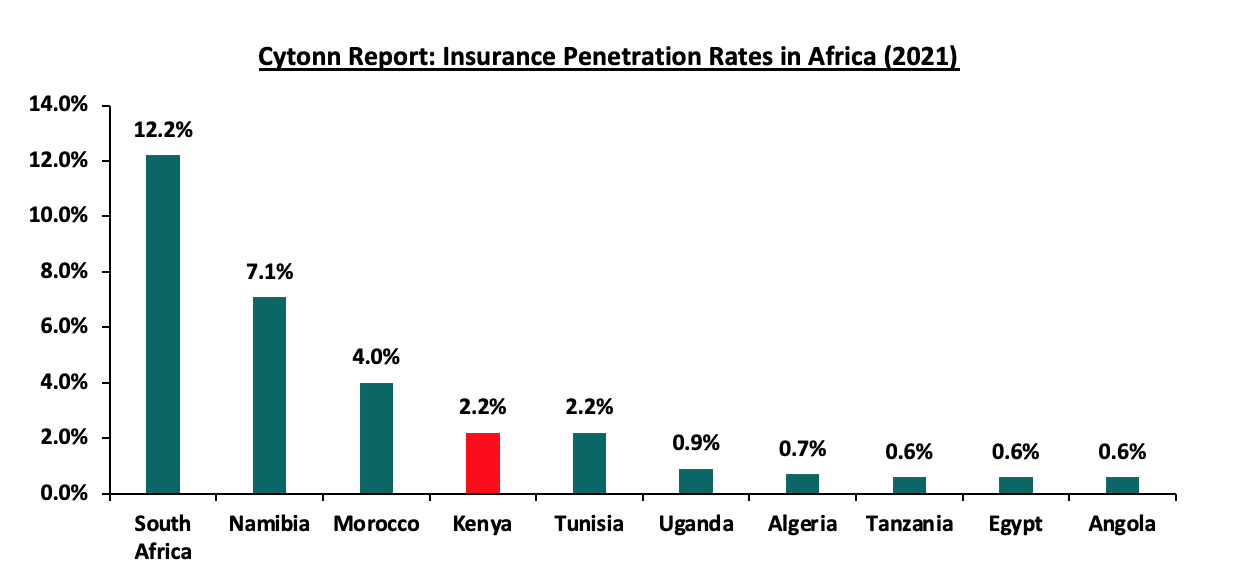

The chart below shows the insurance penetration in other economies across Africa:

Source: Swiss Re, GCR Research, CBK

Insurance penetration in Africa has remained relatively low, averaging 3.1% in 2021, mainly attributable to lower disposable income in the continent and slow growth of alternative distribution channels and technology such as mobile phones to ensure wider reach of insurance products to the masses. Additionally, there has been slow inclusion of diversified products which cater for all income levels and groups. In 2021, South Africa remained the leader in insurance penetration in the continent as a result of mature and highly competitive market, coupled with strong institutions and a sound regulatory environment.

Read: Insurance Industry Pays 1.9 Million Claims In Q2 Of 2022

Key Themes that Shaped the Insurance Sector in H1’2022

Despite the country recording a 5.2% GDP growth in H1’2022, the business environment remained constrained by elevated inflation and supply chain constraints worsened by the geopolitical tensions arising from Russia’s Invasion of Ukraine. According to the Insurance Regulatory Authority(IRA)’s Q2’2022 Industry report, the insurance sector showcased resilience and recorded a 13.2% growth in gross premiums to Ksh163.1 billion in H1’2022, from Ksh144.0 billion in H1’2021.

The general insurance business contributed 56.7% of the industry’s premium income compared to 43.3% contribution by long-term insurance business. During the period, the long-term business premiums grew by 20.5% to Ksh70.7 billion from Ksh58.7 billion in H2’2021 while the general business premiums grew by 8.2% to Ksh92.4 billion from Ksh85.4 billion in H2’2021. Notably, motor and medical insurance classes accounted for 62.5% of the gross premium income under the general insurance business compared to 62.3% in H1’2021. As for the long-term insurance business, the major contributors to gross premiums were deposit administration and life assurance classes accounting for 60.7% in H2’2022, compared to the 59.7% contribution by the two classes recorded in H2’2021.

In the period under review, the net claims for the long-term insurance business increased by 4.7% to Ksh41.3 billion, from Ksh39.4 billion in H1’2021. Similarly, net claims for the general business also increased by 14.5% to Ksh37.1 billion, from Ksh32.4 billion in H1’2022, driven by a 23.4% growth in medical claims to Kshs 15.5 billion in H1’2022, from Ksh12.5 billion in H1’2021.

The NASI index declined by 25.5% in H2’2022 compared to a gain of 9.4% in H1’2021 consequently deteriorating the insurance sector’s bottom line as a result of fair value losses in the equities investments. This has seen the sector continue to reduce its allocation to quoted equities, with the proportion of quoted equities to total industry assets declining to 2.8% in H1’2022, from 4.0% in H1’2021. Key to note, Year to Date (YTD), NASI has also declined by 22.3%, which will continue to have a direct impact on the sector’s bottom-line, due to the expected fair value losses on the quoted securities.

Read: Allianz Completes Acquisition Of Majority Stake In Jubilee Insurance East Africa

The industry recorded improved convenience and efficiency through the adoption of alternative channels for both distribution and premium collection such as Bancassurance and improved agency networks. There was also advancement in technology and innovation making it possible to make premium payments through mobile phones.

The industry also recorded continued recovery from the economic shocks that saw both individuals and businesses seek insurance uptake to cover for their activities, leading to growth in gross premiums which increased by 13.2% to Ksh163.1 billion, from Ksh144.0 billion in H1’2021.

The sector’s investment income declined by 37.0% to Ksh16.6 billion in H1’2022, from Ksh26.3 billion recorded in H1’2021 for long-term insurance businesses, and also declined by 26.5% for general insurance businesses to Ksh4.6 billion, from Ksh6.3 billion recorded in H1’2021. Subsequently, yield on investments for the Insurance sector declined by 1.9% points to 2.8%, from 4.7% in H1’2021.

On valuations, listed insurance companies are trading at a price to book (P/Bv) of 0.7 times, lower than listed banks at 0.8 times. Still, both are lower than their 16-year historical averages of 1.5 times and 1.8 times, for the insurance and banking sectors, respectively. These two sectors are attractive for long-term investors supported by strong economic fundamentals.

Email your news TIPS to editor@thesharpdaily.com