Before you dive in, please SUBSCRIBE TO OUR NEWSLETTER – we bring you the ranking for all Money Market Funds in Kenya every Monday, Wednesday and Friday. Click here.

Money Market Funds (MMFs) have emerged as one of the most popular investment vehicles in Kenya’s financial landscape. These funds offer a unique combination of safety, liquidity, and attractive returns, making them an ideal choice for both novice and experienced investors.

In this comprehensive guide, we’ll delve into the intricacies of MMFs in Kenya, exploring their structure, ecosystem, performance, and the reasons why they’ve become such a cornerstone of Kenyan investment strategies.

What are Money Market Funds?

Money Market Funds are a type of mutual fund that invests in highly liquid, short-term securities. These may include:

- Cash equivalents

- Government securities (such as Treasury Bills)

- High-quality debt instruments issued by corporations

The primary goal of MMFs is to provide investors with a safe haven for their money while offering returns that typically outperform traditional savings accounts.

Structure of Money Market Funds

Understanding the structure of MMFs is crucial for any potential investor. At their core, MMFs are Unit Trust Funds (UTFs) managed by professional fund managers. These experts allocate investors’ money across various asset classes, commonly referred to as Money Market Instruments.

Key Components of MMF Structure:

- Commercial Paper: Short-term, unsecured promissory notes issued by corporations to finance immediate cash flow needs.

- Treasury Bills (T-bills) and Treasury Bonds: Government-issued debt securities used to borrow money from the public.

- Fixed Deposits: Time-bound deposits held in commercial banks, offering a fixed rate of interest.

Investing in an MMF is akin to buying a slice of a diversified financial pie. When you purchase units of an MMF, you’re essentially acquiring a portion of a portfolio that includes commercial paper, treasury bills, and fixed deposits. This structure allows even small investors to access a broad range of financial instruments that might otherwise be out of reach.

The Money Market Funds Ecosystem in Kenya

The MMF ecosystem in Kenya is a well-regulated environment designed to protect investors and ensure the smooth operation of these funds. Let’s examine the key players:

- Professional Fund Manager:

- Registered and regulated by the Capital Markets Authority (CMA)

- Responsible for creating and managing the investment portfolio

- Makes investment decisions aligned with the fund’s objectives

- Custodian:

- Typically a bank approved by the CMA

- Holds investors’ funds and releases them for investment as per the fund manager’s instructions

- Acts as a safeguard, ensuring proper allocation of funds

- Trustees:

- Serve as advocates for investors’ interests

- Hold the Fund Manager and Custodian accountable

- Act as whistleblowers in case of suspected fraud or malpractice

- Chosen by the fund manager and vetted by the CMA

- Auditor:

- Reviews and audits the fund’s financial statements

- Provides investors with verified information to assess fund performance

This multi-layered system of checks and balances contributes significantly to the low-risk profile of MMFs in Kenya.

Performance of Money Market Funds in Kenya

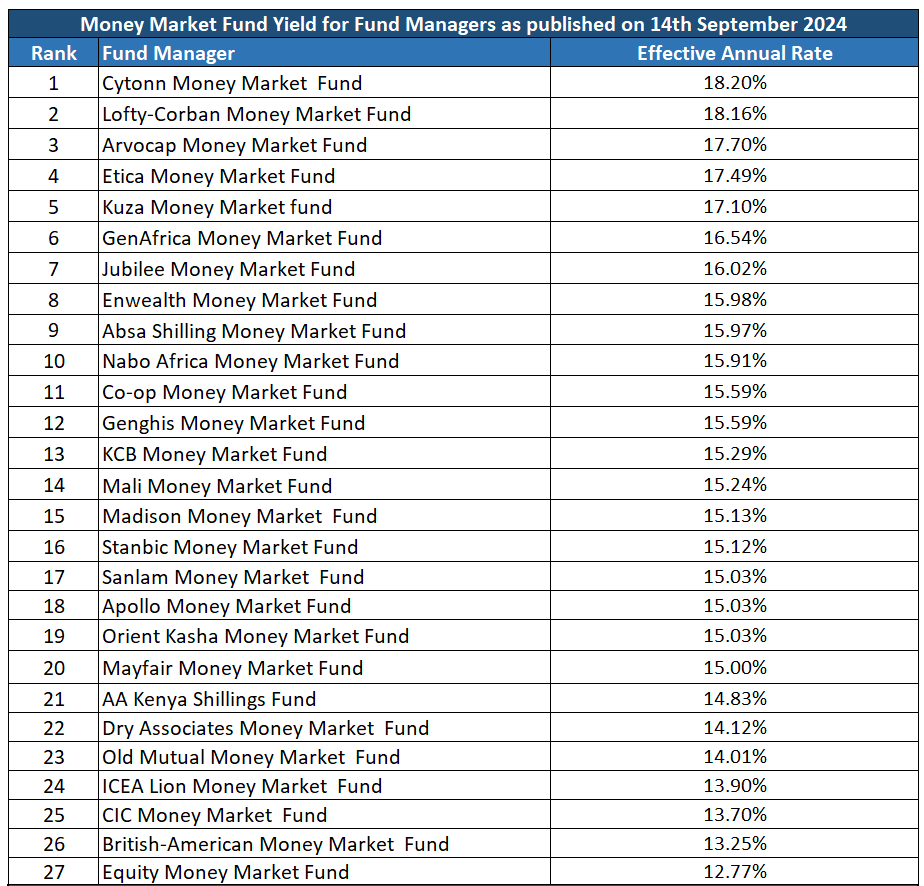

MMFs in Kenya have consistently delivered impressive returns, outperforming traditional savings options and often beating inflation. As of September 2024, the performance of MMFs in Kenya is as follows:

- Returns range from 12.77% to 18.20% (based on the latest rankings)

- Average return across all listed MMFs: approximately 15.50%

- Current inflation rate: 4.4% (as of August 2024)

This performance demonstrates that MMFs are not only preserving capital but also growing it at a rate that significantly outpaces inflation.

Top-Performing Money Market Funds in Kenya (as of September 2024)

- Cytonn Money Market Fund: 18.20%

- Lofty-Corban Money Market Fund: 18.16%

- Arvocap Money Market Fund: 17.70%

- Etica Money Market Fund: 17.49%

- Kuza Money Market Fund: 17.10%

Why Invest in Money Market Funds?

- Attractive Returns: With an average return of 15.50%, MMFs significantly outperform traditional savings accounts and often beat inflation.

- High Liquidity: MMFs invest in short-term securities that can be easily converted to cash, allowing investors to access their funds quickly when needed.

- Strong Regulatory Oversight: The Capital Markets Authority (CMA) closely regulates MMFs, ensuring compliance with strict guidelines and protecting investor interests.

- Professional Management: Experienced fund managers make informed investment decisions based on extensive market research and analysis.

- Low Minimum Investment: Many MMFs in Kenya allow investments starting from as low as Ksh 1,000, making them accessible to a wide range of investors.

- Cost-Effective: Due to economies of scale, MMFs often have lower transaction and management costs compared to individual investing.

- Diversification: MMFs spread investments across various securities, reducing risk through diversification.

- Cultivation of Savings Culture: Regular investments in MMFs can help develop and reinforce positive saving habits.

How to Choose a Money Market Fund in Kenya

When selecting an MMF, consider the following factors:

- Past Performance: Review the fund’s historical returns, focusing on consistency and comparison to market averages.

- Minimum Investment: Ensure the fund’s minimum investment aligns with your financial capabilities.

- Fund Manager Reputation: Research the fund manager’s track record and reputation in the industry.

- Diversification of Investments: Look for funds with a well-diversified portfolio to minimize risk.

- Fees and Charges: Compare the fees charged by different fund managers, as these can impact your overall returns.

- Technological Integration: Consider funds that offer user-friendly digital platforms for easy account management and transactions.

Conclusion

Money Market Funds in Kenya represent a vibrant and growing sector of the country’s financial market. They offer a unique combination of safety, liquidity, and attractive returns that make them an excellent choice for both short-term cash management and long-term wealth building. With low barriers to entry, strong regulatory oversight, and professional management, MMFs are democratizing access to sophisticated financial instruments for Kenyan investors of all levels.

As the Kenyan economy continues to evolve, MMFs are likely to play an increasingly important role in the financial strategies of individuals, businesses, and institutions alike. By understanding the structure, benefits, and performance of these funds, investors can make informed decisions to optimize their financial portfolios and work towards their long-term financial goals.

Remember, while MMFs generally offer lower risk compared to other investment vehicles, it’s always advisable to consult with a financial advisor to ensure that your investment strategy aligns with your personal financial situation and objectives.