Sasini PLC, a publicly traded agricultural company, has issued a profit warning for the fiscal year ending September 30, 2024, citing increased production costs, falling commodity prices, and disruptions in supply chains.

The Nairobi Securities Exchange (NSE)-listed company projects a 25.0% drop in net profits for the year ending September 30, 2024, compared to the same period in the previous year. This anticipated decline is largely attributed to challenges in the fruit business, exacerbated by logistics disruptions in European markets following the Suez Canal closure.

Moreover, the company notes that a severe recession in major economies, particularly in the United States—a key market for Sasini’s nut business—has led to reduced demand.

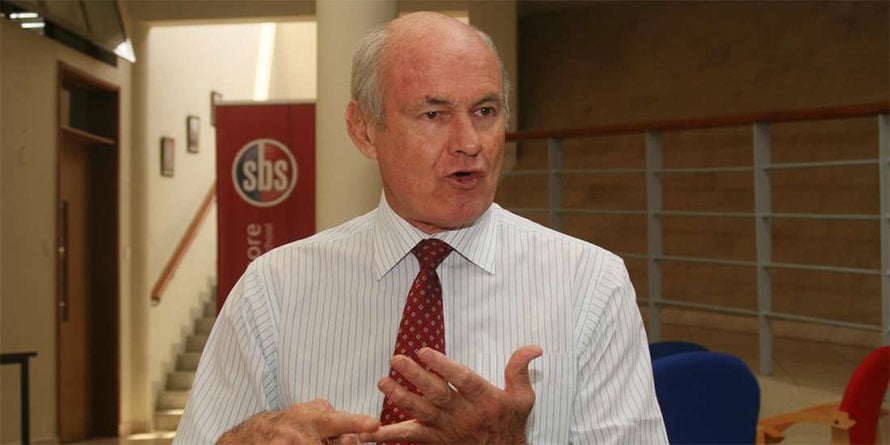

“Based on our financial projections and the information currently available to the Board, we expect our net earnings for the year ending September 30, 2024, to be 25.0% lower than those reported for the year ended September 30, 2023,” stated Board Chairman James Boyd McFie in a public notice.

In its half-year 2024 results, Sasini reported a post-tax loss of KES 37.7 million, driven by a 54.0% increase in the cost of sales. Since 2020, the company has significantly reduced its workforce, citing increased mechanization and a high payroll as the reasons.

“The company’s performance during this period has been severely impacted by various external factors in the global macro environment, with the global economic situation and ongoing geopolitical disruptions in our business value chain being the primary contributors,” McFie added.

Additionally, the company highlighted that recent legislative changes in the coffee sector have further disrupted the supply chain, contributing to the anticipated decline.

Sasini, trading under the ticker symbol SASN on the NSE, closed the previous trading session (9th August 2024) at KES 17.15, reflecting a year-to-date loss of 10.8%.