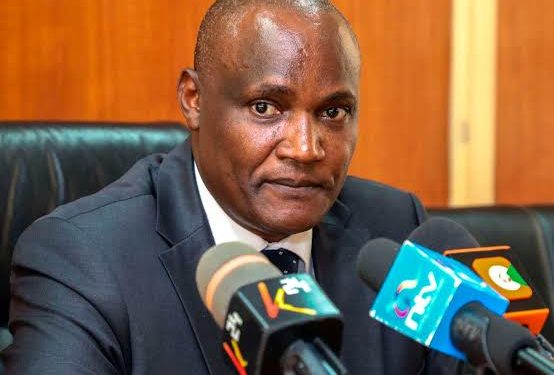

On August 8, 2024, John Mbadi was officially sworn in as Kenya’s new Treasury Cabinet Secretary at State House, Nairobi. In his inaugural hours on the job, Mbadi reaffirmed his commitment to addressing Kenya’s pressing fiscal issues, with a strong focus on reforming the country’s tax and debt systems.

“We cannot continue with the current trajectory where loans are approved without a clear plan or project to tie them to. Every shilling borrowed must serve a clear purpose,” Mbadi asserted.

Mbadi, who replaces Njuguna Ndung’u, steps into a role fraught with challenges. His predecessor was among those who lost their positions following youth-led protests that erupted on June 18, driven by dissatisfaction with the government’s fiscal policies, including increased taxation.

“The focus has been that we should be changing tax rates, increasing taxes, and introducing new taxes, but I don’t think that should be the solution. The solution to tax mobilisation should be targeting the tax collector,” Mbadi told lawmakers during his vetting, signaling a shift from the current tax policies that have burdened formal workers and businesses alike.

Addressing the issue of debt, Mbadi highlighted the alarming practice of paying commitment fees for undrawn loans. “In the last financial year alone, Kenya spent Sh1.44 billion on commitment fees for loans that were never utilized. This is unacceptable, and we must ensure that loans are drawn and applied to their intended projects swiftly,” he stated.

Mbadi also committed to making the debt register public, a move aimed at increasing transparency. “Kenyans deserve to know the details of the loans we are taking on their behalf. I will make it a priority to ensure that this information is readily available to the public,” he pledged.

On the issue of tax compliance, Mbadi acknowledged the concerns raised by businesses, particularly alcohol manufacturers, who have struggled with the new excise duty remittance requirements. “We must strike a balance between collecting revenue and ensuring that businesses can operate smoothly. I will work to make tax compliance less costly and more straightforward,” he assured.