Kenya will transition to accrual accounting from cash-based accounting starting July 1, marking a major overhaul aimed at improving transparency and fiscal reporting, the government announced on Tuesday.

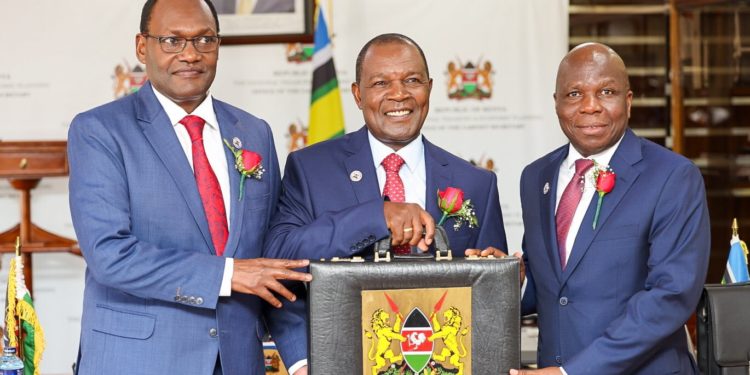

In his budget speech to parliament, Treasury CS Njuguna Ndung’u unveiled the long-awaited shift, stating it will allow the the country to account for all assets and liabilities, including debt, pending bills and pensions.

“The transition to accrual accounting from cash basis marks a significant milestone in our nation’s journey to strengthen public finance management,” Mr Ndung’u told lawmakers. “In recognition of this, the Cabinet in March 2024 approved the transition to improve cash management and enhance financial and fiscal reporting.”

The move comes amid growing calls for more openness over Kenya’s debt levels and future liabilities, which have faced scrutiny from institutions such as the International Monetary Fund. Analysts say accrual accounting will make it harder to obscure spending obligations.

“With accrual accounting we will also be able to account for all pending bills, public debt and pension liabilities,” Mr Ndung’u said in his speech, citing key benefits of the overhaul.

The shift aligns Kenya with best practices and the requirements of institutions such as the IMF and World Bank. It follows a pilot programme testing accrual accounting in several ministries and county governments.

“This is an important step to strengthen public finance management, and I therefore direct all MDAs [ministries, departments and agencies] and county governments to migrate to accrual accounting starting 1st July 2024,” the finance minister stated.

The budget speech outlined other reforms, including setting up a treasury function to manage cash consolidation and rolling out an integrated revenue management system in counties to boost transparency.

The budget statement projected economic growth of 5.5 percent in 2024 and 2025, supported by interventions under the government’s “Bottom-Up Economic Transformation Agenda” focused on areas like agriculture, housing and healthcare.

Overall, the CS struck an upbeat tone, saying: “The policies and structural reforms outlined in this budget have laid a firm foundation to protect this fragile recovery for a sustained socio-economic transformation.”