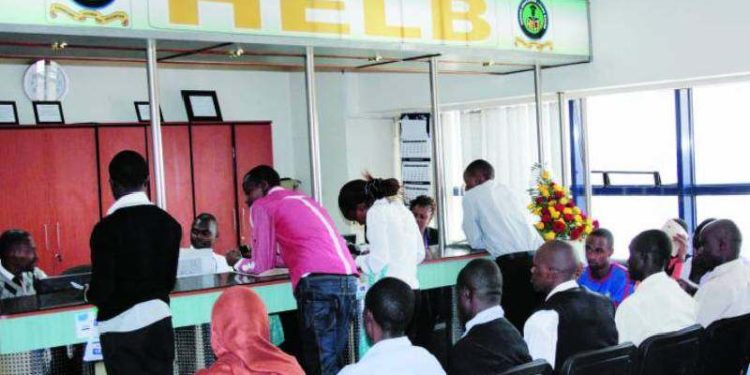

In the new budget releases, Kenya’s National Treasury has proposed to cut the Higher Education Loans Board (HELB) budget by KES 3.7 billion in FY’2024/25 to KES 33.3 billion from the KES 37 billion allocated in FY’2023/2024. As a result, needy students, who heavily rely on these loans to sustain their education, are likely to bear the brunt of this decline, which will continue given a government that seeks to preserve its revenue for other operations.

As Kenya’s higher education landscape continues to evolve, it’s crucial to explore alternative financing options to support students in pursuing their academic aspirations. While HELB remains a vital source of funding, its budgetary constraints highlight the need for innovative approaches to ensure financial sustainability and inclusivity in higher learning institutions.

One potential avenue for future financing is the expansion of scholarship programs, both within government institutions and through private-sector partnerships. Scholarships provide an excellent opportunity to support deserving students who may not qualify for traditional loans or face financial constraints. By leveraging partnerships with corporations, philanthropic organizations, and international donors, universities can establish robust scholarship funds to broaden access to education and promote academic excellence.

Furthermore, the integration of income-sharing agreements (ISAs) could offer a viable alternative to traditional loans. ISAs allow students to finance their education with no upfront costs, instead agreeing to pay a fixed percentage of their post-graduation income for a specified period. This model aligns the interests of students and institutions, ensuring that graduates contribute to the cost of their education based on their financial success in the workforce.

Additionally, exploring opportunities for public-private partnerships (PPPs) can unlock new avenues for financing higher education. Through PPPs, governments can collaborate with private investors to develop infrastructure, expand access to educational resources, and establish sustainable funding mechanisms.

The future of financing higher education in Kenya lies in embracing a multi-faceted approach that combines traditional funding mechanisms with innovative solutions tailored to the evolving needs of students. By fostering collaboration, innovation, and inclusivity, stakeholders can ensure that every aspiring learner has the opportunity to fulfill their academic potential and contribute to the socio-economic development of the nation.