Jumia Technologies has announced a 67 percent reduction of its adjusted losses in its third quarter results, recording a USD 15 million loss an improvement on its USD 46 million loss in the third quarter of 2022.

“Costs have been streamlined while maintaining strong execution on priority projects, operations have become more efficient while growing our footprint outside of the main cities and sales and advertising expenses have decreased while building stronger fundamentals for profitable growth,” stated Francis Dufay, Jumia CEO in a press release.

Read more: Kenya clinches KES 142.8 billion deal with IMF

Attributing this turnaround to its new strategy which emphasizes cost saving measures such as scaling back its marketing budget by 73 percent from USD 16 million to USD 4.3 million and an emphasis on growing its physical good business by expanding its geographical reach outside of major cities. All with the aim of tapping into underserved markets while addressing supply and distribution challenges in African regions.

The company also reported a decline in revenue, down 11 percent year-over-year from USD 50 million to USD 44.9 million, it emphasized the growth of its Gross merchandise value (GMV) of physical goods in five of its key markets driven by an improved supply in its core categories of phones, electronics, home & living and fashion & beauty.

Jumia also recorded a reduced liquidity position standing at USD 147 million, a decrease of USD 19 million in its third quarter results with the company justifying the reduction as part of its efforts to preserve available cash resources.

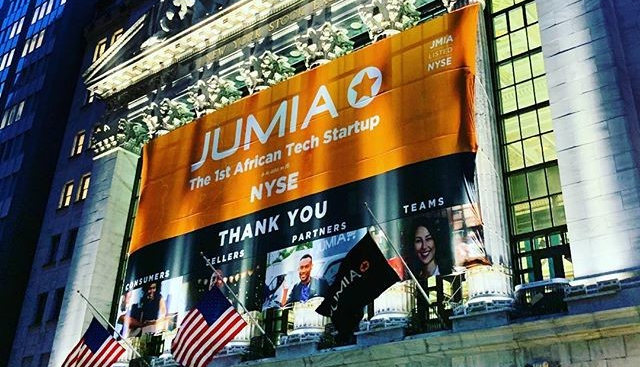

Since its initial public offering (IPO) on the New York Stock Exchange in April 2019, Jumia, often hailed as the “Amazon of Africa,” has faced significant challenges. Initially valued at USD 1.4 billion, the company’s value soared to over USD 3 billion by the end of the first day’s trading. However, within a few weeks, the company’s stock suffered a significant decline, weighed down by allegations of fraud and concealed losses. Causing share prices to tumble, falling nearly 70% since its IPO.

Read more: Rystad Energy Report: Africa to invest USD 35 billion in geothermal sector

Since then the company has exited 14 countries refocusing on core efficiency and profitability and shifting it product management to develop a more sustainable business for the long-term.

Email your news TIPS to editor@thesharpdaily.com