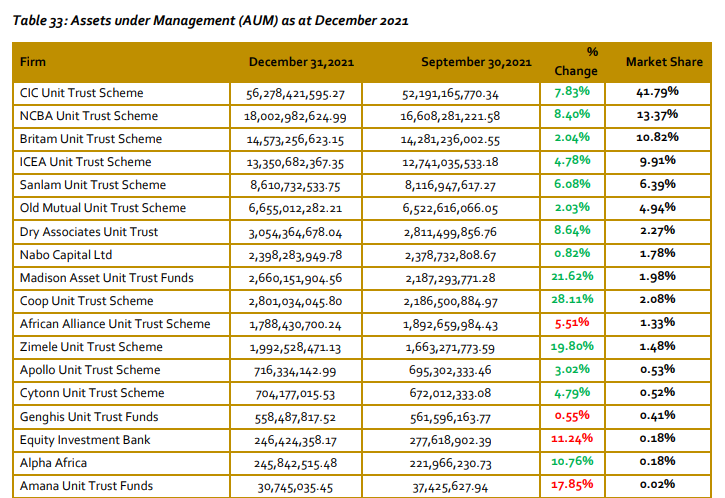

Collective Investment Schemes (CIS) popularly known as Unit Trust Funds’ assets under management have hit a record high of Ksh134.67 billion in the year ended December 2022 according to data by the Capital Markets Authority (CMA).

This is Ksh30 billion more as compared to Ksh104.7 billion assets handled in the year ended December 2020, or a growth of 26.62 percent. As of September 2021, the trust schemes managed at least Ksh126.05 billion worth of assets.

CIC Unit Trust Scheme maintained the lead in managing the highest assets of Ksh56.28 billion which represents 41.79 percent of the total assets under management, followed by NCBA Unit Trust Scheme which managed Ksh18 billion.

Read: Investors in CHYS/CPN Want Administrator Removed

The least portion of the total assets under management accounting for 0.0004 percent was managed by Nabo under its Wanafunzi Umbrella Scheme targeting students.

Despite having sent its private real estate funds, Cytonn High Yield Solution (CHYS) and Cytonn Private Notes (CPN), to administration, Cytonn UTFs grew by 4.8 percent for the quarter from 672 million to 704.2 million.

“The total Assets Under Management by Collective Investments Schemes has been showing consistent growth in the recent years. As at the end of 2021, the total assets managed under this asset class totalled Ksh134.67 billion, a 6.84 percent increase from Ksh126.05 billion managed in the

quarter ended September 30, 2021,” said CMA CEO Wyckliffe Shamiah.

Read: Cytonn Launches Hospitality Company Focused On Serviced Apartments

A Quarter-on-Quarter comparison of Performance between the fourth quarter of 2021 and the third quarter 2021 indicates that Coop Unit Trust Scheme registered the highest percentage increment of 28.11 percent recording Ksh2,801,034,045.80 as at December 31, 2021, from Ksh2,186,500,884.97 recorded in the previous quarter.

On the other hand, Amana Unit Trust Funds recorded the highest decline of funds managed by 17.85 percent, recording an asset under management of Ksh30.75 million in the fourth quarter of 2021 from Ksh37.43 million reported in the third quarter of 2021.

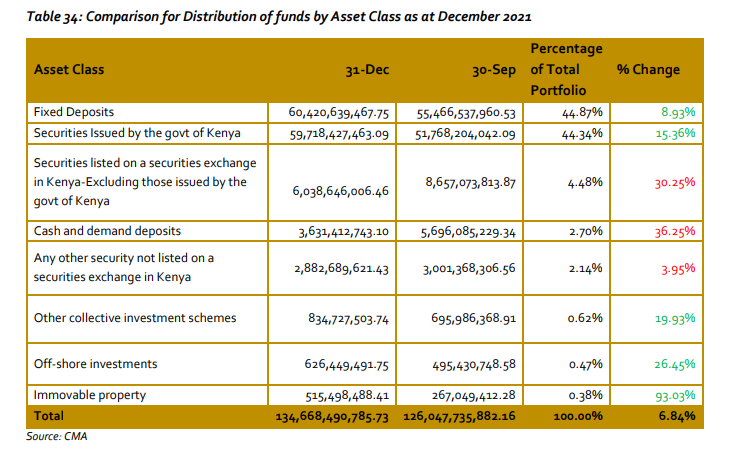

During the period under review, 44.87 percent of the total assets under management were invested in fixed deposits which was an 8.93 percent increase to Ksh60.42 billion in the fourth quarter of 2021 compared to Ksh55.47 invested in the third quarter of 2021.

The least amount of the assets under management at 0.38 percent was invested in immovable property. Notably, investments in the immovable property recorded an 93.03 percent increase from Ksh267.05 million invested in the third quarter of 2021 to Ksh515.50 million invested in the fourth quarter.

Read: Nicholas Bodo Appointed Kenya Civil Aviation Authority Acting Director-General

” The largest proportion of these investments were in fixed deposits and government securities, accounting to 85.21 percent of the total portfolio distribution at the close of the 2021 calendar year,” added Shamiah.

The fact that that 85 percent percent of the UTFs are invested in government bonds and bank deposits reflects the challenges of getting funding for businesses from capital markets.

The derivatives market suffered reduced activity during the quarter as well. The market experienced a 28.04 percent decrease in the volume traded closing the quarter at 1,188 contracts in quarter one of 2022 compared to 1,651 contracts traded in the fourth quarter of 2021. Similarly, the turnover recorded a 30.27 percent decrease closing the quarter at 43.60 million compared to 62.53 million recorded in the fourth quarter of 2021. The number of deals also decreased by 30.10 percent in the first quarter of 2022, closing the quarter at 339 deals from 485 deals registered in the previous quarter.

Read: Andrew Bulemi Ukiru Appointed To Cytonn’s Audit, Risk and Compliance Committee