Retirement benefit schemes are savings platforms that allow members to make regular contributions during their working years and upon retirement, members are paid their total contribution plus the interest accrued.

Members are also entitled to their benefits before retirement due to circumstances such as resignation or inability to work due to medical reasons. Retirement schemes often require their members to make regular contributions in order for them to build up a large retirement pot and to take the maximum advantage of compound interest. The contribution amounts vary based on the types of schemes but for individual pension schemes, the monthly contribution may be as low as Ksh1,000.

Below we look at the various types of retirement benefits schemes based on three

different classifications:

a. Classification based on Membership

i. Individual Retirement Benefit Schemes – These are schemes that allow individuals to make contributions towards saving for their retirement. They are open to anyone who is earning an income.

Read: Sanlam, Allianz Merge To Form African Insurance Giant

ii. Umbrella Retirement Benefit Schemes – These are schemes that pool the retirement contributions of multiple employers and their employees thereby reducing the employees’ contribution and enhancing the overall benefits to the members.

b. Classification based on Mode of Payment upon Retirement

i. Pension Schemes – These are retirement schemes whereby members may access up to a maximum of a third of their benefit while the remainder is used to purchase annuities from insurance companies or approved issuers. By purchasing an annuity, the retiree gives the insurance company a lump sum in exchange for the Insurance company paying a periodic income to the retiree for a defined period as stipulated in the contract.

Read: Xplico Insurance Battles Liquidation Suit

ii. Provident Schemes – These are retirement schemes whereby members are paid the total amount of savings plus the interest accrued. The Lump sum amount can be used to purchase an annuity or invested in an Income Drawdown Fund where the retiree gets a periodic income while at the same time the pension fund remains invested in a Retirement Benefits Scheme.

iii. Income Drawdown Funds – These are funds that are open only to members who are retiring and have attained the minimum retirement age of 50 years. The retirees transfer the benefits received from their current schemes into income drawdown funds, whereby their benefits are locked in for a minimum period of 10 years with a provision to withdraw from the scheme up to a maximum of 15.0% per annum of their fund balance every year. The remaining balances after withdrawal are continually invested.

Read: Independent Post-Retirement Medical Schemes To Be Licensed -RBA

c. Classification based on Mode of Investments

i. Guaranteed funds – These are schemes offered by Insurance companies whereby members’ contributions are pooled together and the insurance companies guarantee a minimum rate of return. The funds are invested in primarily low-risk investment classes such as Government securities. In case of overperformance, some of the returns on investment are placed in a reserve pool that can be used later on in the event that the market performance does not meet the minimum guaranteed rate, while the remainder is distributed to the members. Key to note is that the interest rate and risk for guaranteed funds is less than for segregated funds, and,

ii. Segregated fund – These are schemes whereby the members’ contributions are invested directly by the Trustee via an appointed Fund manager. All the Interest earned minus the fund expenses are allocated to the member. However, the rate of return is not guaranteed and instead depends on the market’s performance. Based on historical performances, segregated funds have delivered an average return of 11.3% outperforming guaranteed funds which have an average return of 9.5% in the last 7 years.

Read: 7 Million NHIF Members Risk Losing Cover Over Huduma Namba

Retirement benefit schemes play a huge role in our society, especially in enabling people to enjoy their retirement. Some of the benefits of joining a Retirement Pension scheme include:

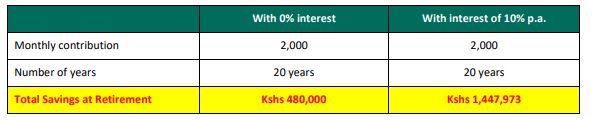

a. Growth of savings – The members’ savings are invested in prudently identified ventures in order to facilitate the growth of members’ savings. The savings grow at a compounded interest rate and this enables faster growth of member savings. Below is an illustration of retirement benefits when the savings earn no interest and when the savings earn a constant compounded interest of 10% per annum:

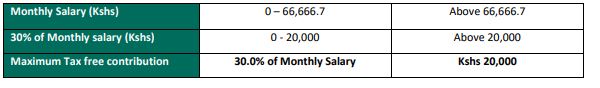

b. Tax-exempt Contributions – Members of Retirement Benefits Schemes are entitled to a maximum tax-free contribution of Ksh20,000 monthly or 30.0% of their monthly salary, whichever is less. Consequently, pension scheme members enjoy a reduction in their taxable income and pay lesser taxes.

Read: Broke KBC Unable To Meet Its Financial Obligations

Below is an illustration of the applicable tax exemption of monthly contributions:

c. Home ownership – Pension schemes allow members to use up to a maximum of 60.0% of their accrued retirement benefits as collateral for mortgage loans and a maximum of 40.0% of their savings for home purchases.

d. Additional Benefits – There are schemes that have added life cover into their pension schemes that pay their members and beneficiaries an agreed sum of money depending on the member’s total savings upon death, permanent disability or Critical illness of their members.

Read: Importance Of Including Insurance In Your Financial Plan

e. Financial Independence – Pension scheme enables retirees to maintain their standards of living in retirement as they are paid a lump sum or a monthly stipend that caters for their expenses. Some of these expenses, such as medical expenses, increase as one gets older. For instance, one pays more premiums for medical insurance when they are old as compared to when they are young.

In conclusion, in order to enjoy your retirement years, one needs a stable form of income given that formal employment is not an option. This is one of the main reasons why you should join a Retirement Benefit Scheme and make regular contributions in your employed years. Taking into consideration the diversity of benefits from the various Retirement Benefits Schemes in the country, one needs to consult a financial advisor before making a decision on which scheme to join. This will enable one to choose a scheme that aligns with their goal and be able to accumulate enough gold for their golden years.

Read: Factors To Consider When Investing in Real Estate