The Kenyan investment landscape has witnessed a dramatic shift as special funds challenge the long-held dominance of money market funds (MMFs). According to recent data from the Capital Markets Authority, MMFs’ share of total pooled investor funds dropped from 62.2% in September 2024 to 58.9% by September 2025, while special funds surged from 13.6% to 20.3% during the same period.

This trend has sparked an important conversation among investors: Are special funds truly superior to traditional MMFs, or is there more to the story? More importantly, how do you navigate these options without falling victim to the fear and confusion that often paralyzes potential investors?

The Special Funds Appeal: Higher Returns Come With Trade-offs

Special funds have attracted investors primarily through their promise of above-market returns. Fund managers report charging fees as high as six percent per annum for these specialized products, which invest in alternative assets including real estate, private equity, offshore investments, and unlisted securities.

The numbers tell a compelling story. While the highest-yielding money market fund delivered returns around 17% last year, some special funds achieved rates between 18-19%. This 1-2 percentage point difference has proven sufficient to drive significant capital reallocation, with special funds’ asset base reaching Sh136.7 billion.

However, these higher returns reflect a fundamental investment principle: greater risk commands greater reward. Special funds expose investors to less liquid assets, early exit penalties, and substantially higher management fees. They’re designed for investors with longer time horizons and higher risk tolerance—not for those who might need emergency access to their funds.

Why MMFs Remain Relevant and Competitive

Money market funds continue to offer distinct advantages that shouldn’t be overlooked in the current discussion. Their appeal lies in three core strengths that address practical investor needs:

- Liquidity and Flexibility MMFs provide same-day or next-day access to funds, making them ideal for emergency reserves and short-term savings goals. According to financial expert Rhina Namsia, this liquidity ranking places MMFs just below bank accounts in accessibility. In contrast, special funds often impose restrictions on early withdrawals and may require advance notice, potentially leaving investors stranded when unexpected expenses arise.

- Lower Fee Structures. With competitive management fees typically ranging from 2-3% compared to special funds’ 5-6%, MMFs offer cost-effective wealth accumulation. The absence of penalties for early exits means investors maintain full control over their money. This fee differential can significantly impact net returns over time—a factor often overlooked when comparing headline return figures.

- Stability and Transparency Investing primarily in government securities, Treasury bills, and commercial bank fixed deposits, MMFs deliver predictable returns with minimal volatility. This makes them suitable for risk-averse investors and those seeking capital preservation alongside growth. The transparency of these underlying assets also reduces concerns about fraud or mismanagement—a legitimate worry given Kenya’s history with failed investment schemes.

Understanding Your Investment Foundation: Start Smart, Not Scared

You want to invest in 2026, but the questions are overwhelming. Where do you even start? How much do you need? And with memories of failed chamas, rogue apps, and pyramid schemes that sank people’s savings, how can you be sure your money is safe?

The truth is, investing isn’t just for the wealthy or financially savvy. It’s a journey anyone can begin with the right mindset and knowledge.

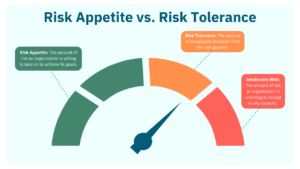

The First Question: What’s Your Risk Appetite?

Financial experts emphasize that understanding your risk tolerance shapes every investment decision. According to Mwenda Rarama, investors should ask themselves: When do I need the money? How fast can I get it out? What are the total fees? Who is managing my money?

This is where the decision between special funds and MMFs becomes personal rather than universal. Your choice should reflect:

- Your timeline (short-term needs vs long-term goals)

- Your ability to handle potential losses

- Your liquidity requirements

- Your existing financial safety net

Building a Practical Risk Ladder

Instead of viewing investments as binary choices, consider this framework:

- Immediate liquidity: Bank accounts and MMFs (same-day to next-day access)

- Flexible deposits: Treasury bills and MMFs (moderate notice periods)

- Medium-term growth: Fixed income funds and bonds

- Long-term appreciation: Equity funds and special funds

- Alternative investments: Listed stocks and specialized portfolios

The Cytonn Money Market Fund: Balancing Safety and Growth

As market dynamics evolve and investors face increasingly complex choices, the quality of fund management becomes paramount. The Cytonn Money Market Fund combines competitive returns with robust risk management and transparent operations.

Here’s what makes CMMF a solid foundation for both new and experienced investors:

Transparency You Can Trust.

Unlike some investment vehicles where underlying assets remain opaque, CMMF invests in clearly defined government securities and regulated financial instruments. Ask for the fact sheet—if you can’t understand what’s invested in, request a simpler explanation. A good fund manager will always provide clarity.

Competitive Returns Without Excessive Risk.

While special funds chase higher yields through alternative assets, CMMF delivers consistent returns that outpace inflation without exposing investors to illiquid or high-risk instruments. This balance proves particularly valuable when markets experience volatility.

Flexibility for Life’s Uncertainties

Life throws unexpected expenses your way—medical emergencies, business opportunities, family needs. CMMF’s liquidity ensures you’re never trapped, unlike special funds that may impose notice periods or penalties for early withdrawal.

Making the Right Choice: Special Funds vs MMFs

The special funds versus MMFs debate shouldn’t be framed as an either-or proposition. Sophisticated investors recognize that both instruments serve different purposes within a diversified portfolio.

MMFs Excel As:

- Emergency fund foundations (3-6 months of expenses)

- Parking funds between major investment decisions

- Core holdings for conservative investors prioritizing capital safety

- Entry points for those new to collective investment schemes

- Short-term savings vehicles for specific goals

Special Funds Complement Portfolios When:

- You’ve established adequate emergency reserves in MMFs

- You’re investing with medium to long-term horizons (5+ years)

- You understand and accept the illiquidity constraints

- You can afford to take calculated risks for enhanced returns

- You’re building a diversified portfolio beyond traditional fixed-income securities

What Does “Diversification” Mean, and Why Does It Matter?

Financial consultant Rhina Namsia explains diversification simply: it’s not putting all your eggs in one basket. If one investment underperforms, others keep you moving toward your goal.

To avoid locking up all your funds, experts recommend building a diversified portfolio that balances:

- Liquidity (MMFs for immediate access)

- Income (bonds or fixed income funds for steady returns)

- Growth (equity funds or special funds for long-term appreciation)

This approach means you might hold 40% in MMFs, 30% in fixed income funds, and 30% in special funds or equities—adjusting based on your personal circumstances, risk tolerance, and timeline.

The Inflation Factor: Why Sitting Still Costs More Than Risk

Mercy Gatukui, a financial expert, explains that inflation is eroding money’s purchasing power. If inflation runs at 5% annually and your investment earns 4%, you’re effectively losing 1% in purchasing power per year. Your actual return has shrunk in value.

This reality makes the choice between special funds and MMFs less about “risky versus safe” and more about “appropriate risk for appropriate returns.” MMFs typically outpace inflation while maintaining safety, making them effective wealth preservation tools. Special funds aim to exceed inflation by wider margins but require accepting reduced liquidity and higher fees.

Practical Steps for 2026 Investors

- Start with Your Foundation. Before exploring special funds, establish your emergency fund in an MMF. Financial experts recommend 3-6 months of expenses in accessible investments. The Cytonn Money Market Fund provides this foundation with competitive returns and next-day liquidity.

- Assess Your Timeline. Determine when you’ll need your money. Buying a house in two years? Stick with MMFs and short-term instruments. Planning for retirement in 20 years? Consider allocating portions to special funds and equities while maintaining MMF holdings for flexibility.

- Understand All Costs. Don’t just compare headline returns. Calculate net returns after fees, penalties, and taxes. A special fund returning 18% with 6% fees delivers 12% net, while an MMF returning 15% with 2.5% fees delivers 12.5% net—plus liquidity advantages.

- Start Small and Scale Up. You don’t need massive capital to begin. Most MMFs, including CMMF, accept relatively small initial investments. Start where you are, contribute consistently, and let compound interest work its magic. Delay costs more than risk when it comes to long-term wealth building.

- Seek Professional Guidance. Visit investment desks at major banks or contact fund managers directly. Most now offer digital sign-up options. Ask questions until you understand exactly what you’re investing in—legitimate fund managers welcome informed investors.

The Nairobi Securities Exchange Alternative

Everyone talks about the stock market. Is it a good time to buy shares? The Nairobi Securities Exchange has shown resilience, but timing the market proves notoriously difficult. Instead of “timing,” focus on “time in” the market—starting early matters more than starting at the perfect moment.

However, direct stock investing requires research, monitoring, and higher risk tolerance. For most investors, starting with MMFs and gradually exploring equity funds or special funds provides a more manageable learning curve.

Red Flags to Watch For

Given Kenya’s unfortunate history with investment fraud, maintain healthy skepticism:

- Unrealistic promises: Returns significantly above market rates (25%+ annually) warrant scrutiny

- Pressure tactics: Legitimate investments don’t require immediate decisions

- Lack of transparency: If they won’t show you fact sheets or explain investments clearly, walk away

- Unregulated operators: Verify fund managers are licensed by the Capital Markets Authority

- Complex structures: If it seems deliberately confusing, it might be

The Verdict: Special Funds vs MMFs in 2026

The increased popularity of special funds reflects legitimate investor appetite for diversification and enhanced returns. However, MMFs retain crucial advantages that make them indispensable for most portfolios:

Choose MMFs when you prioritize:

- Capital preservation with modest growth

- Immediate access to funds

- Lower fees and transparent costs

- Reduced complexity and risk

- Foundation building before exploring alternatives

Consider special funds when you have:

- Solid emergency funds already established in MMFs

- Long investment horizons (5+ years minimum)

- Comfort with illiquidity and higher fees

- Understanding of underlying assets and risks

- Desire for portfolio diversification beyond traditional instruments

For most Kenyan investors, the optimal strategy involves both maintaining substantial MMF holdings for liquidity and stability while strategically allocating portions to special funds for enhanced long-term returns. This balanced approach captures the benefits of both vehicles while managing their respective limitations.

Conclusion: Start Today, Invest Smartly

The special funds versus MMFs discussion ultimately isn’t about which is “better”—it’s about which is better for you, right now, given your circumstances. Rather than fear paralyzing your investment journey, let knowledge empower your decisions.

The Cytonn Money Market Fund provides an excellent starting point: competitive returns, robust security, transparent management, and the liquidity needed for life’s uncertainties. Whether it becomes your entire investment or the foundation for a diversified portfolio, it offers the balance most investors need.

Begin where you are. Start with what you have. Grow from there. The investment landscape will continue evolving, but the fundamental principles remain constant: match investment vehicles to personal objectives, understand what you’re investing in, and maintain appropriate diversification.

Your 2026 investment journey starts with one decision. Make it an informed one.