Planning for retirement is an essential aspect of financial management, and one of the key strategies in securing a comfortable retirement is asset diversification. Retirement benefits schemes, whether pension funds or individual retirement accounts, aim to provide financial stability during retirement years. Asset diversification within these schemes is crucial as it helps spread risk and maximize returns, ensuring a balance between stability and growth.

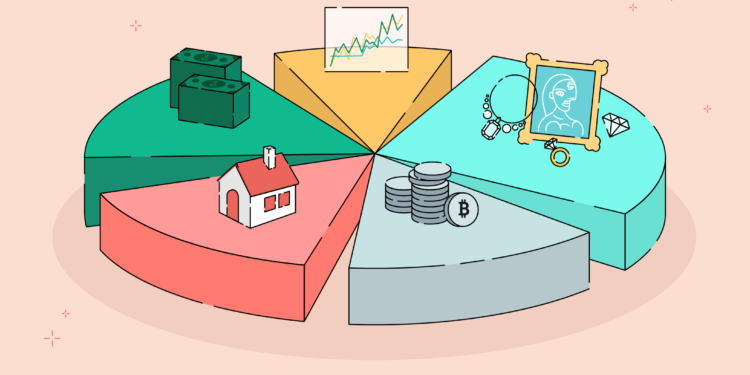

Asset diversification involves spreading investments across different asset classes such as stocks, bonds, real estate, and alternative investments like commodities or private equity. The rationale behind diversification is simple: different assets perform differently under various market conditions.

For retirement benefits schemes, the need for asset diversification is even more pronounced. These schemes serve as the primary source of income during retirement, and the goal is to ensure that retirees have sufficient funds to cover living expenses and maintain their desired lifestyle. Asset diversification plays a crucial role in achieving this goal by:

- Mitigating Risk: Retirement benefits schemes typically have a long investment horizon, spanning several decades. During this period, economic and market conditions can fluctuate significantly. By diversifying across different asset classes, the impact of adverse market movements on the overall portfolio can be minimized. For example, if stock prices decline, the impact may be offset by gains in bonds or alternative investments.

- Enhancing Returns: Diversification not only helps mitigate risk but also has the potential to enhance returns. Different asset classes have unique risk-return profiles, and by combining them in a diversified portfolio, investors can achieve a balance between growth and stability. While stocks may offer higher returns over the long term, bonds provide income and act as a buffer during market downturns.

- Preserving Capital: Preservation of capital is paramount for retirement savings. Asset diversification helps protect the principal amount invested, ensuring that retirees have a stable source of income throughout their retirement years. By avoiding overexposure to any single asset class, retirees can reduce the risk of significant capital erosion due to market volatility.

- Adapting to Changing Needs: As retirees progress through different stages of retirement, their financial needs and risk tolerance may change. Asset diversification allows for flexibility in adjusting the portfolio to meet evolving requirements. For example, as retirees age, they may prioritize capital preservation over growth, prompting a shift towards more conservative investments.

Effective asset diversification requires careful planning and consideration of various factors, including risk tolerance, investment objectives, time horizon, and market conditions.