The real estate sector recorded increased activity, attributed to the recovery of the sector following increased property transactions, according to the Cytonn Real Estate H1’2022 Markets Review.

In the Nairobi Metropolitan Area (NMA), the residential sector registered improved performance with average total returns coming in at 5.8%, 0.3% points increase from 5.5% recorded in H1’2021. The average rental yield for office spaces slightly increased by 0.02% points to 7.35% from 7.33% in FY’2021, mainly driven by an increase in the average rental rates, while the average rental yield for retail spaces remained the same at 7.8%, when compared to FY’2021 performance.

The average selling prices for land in the Nairobi Metropolitan Area (NMA) recorded an overall improvement in performance with the YoY capital appreciation coming in at 3.1%.

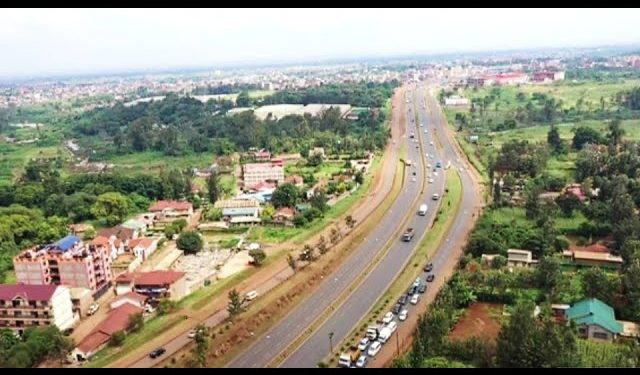

“Some of the key factors that have continued to shape the performance of the sector include continued focus on affordable housing, efforts by the government to provide affordable mortgages, increased business operations by firms and small and medium-sized Enterprises, positive demographics, rapid infrastructure developments promoting property investments, and aggressive expansion by local and international retailers,” stated Linah Onyango, a research analyst at Cytonn Investments.

Read: Nairobi Expressway Eats Into Mombasa Road Offices Yields

Conversely, there exists a couple of challenges facing the sector such as constrained lending to the real estate sector amidst an increase in non-performing loans (NPLs), an increase in prices of construction materials, oversupply in select real estate sectors such as the commercial office and retail sectors, shift towards e-commerce affecting the uptake of retail spaces, and continued poor performance of the REIT market.

In the residential sector, detached units registered average total returns of 5.6% y/y while apartments recorded an average total return of 6.0% y/y. Detached units in Ruiru, Rosslyn, Juja, and Redhill, recorded the highest average y/y returns at 7.8%, 7.5%, 6.7% and 6.4%, respectively, while apartments in Thindigua, Ruaka, Waiyaki Way, and, Kikuyu, recorded the highest average y/y total returns of 7.5%, 7.4%, 7.3%, and, 7.3% respectively.

In the commercial office sector, Gigiri, Westlands and Karen recorded the highest rental yields of 8.6%, 8.1%, and, 7.9%, respectively, in H1’2022 compared to the market average of 7.3%. Their performance was mainly driven by the presence of high-quality office spaces that generate prime rents.

Read: Why Nairobi Presents The Best Investment Opportunities – Report

In the retail sector, Kilimani, Westlands, and, Karen were the best performing nodes with average rental yields of 9.7%, 9.0% and 8.9%, respectively, compared to the overall market average of 7.8%. The remarkable performance was driven by the presence of quality retail spaces fetching prime rents and yields, their superior locations containing affluent residents with a high consumer purchasing power, and adequate infrastructure enhancing investments.

For the land sector, un-serviced land in the satellite towns of Nairobi recorded the highest YoY capital appreciation of 7.8%. This was mainly due to: increased demand resulting from their affordability, scarcity of land within Nairobi which in turn drove demand for land in the satellite towns, the concentration of affordable housing projects in the satellite towns thus driving demand for land, and, improved accessibility to these areas supporting demand for Real Estate investments.

The outlook of the Real Estate sector is positive for one Sector-Land, and neutral for six Sectors-Residential, Commercial Office, Retail, Hospitality, and, Listed Real Estate. Therefore, our overall outlook for the Real Estate sector is neutral, supported by; positive demographics, improving infrastructure, continued focus on the affordable housing front, and improved access to mortgages. The performance of the sector is likely to be constrained by the existing oversupply in the commercial office font and the retail sector, reduced consumer purchasing power brought about by the tough economic environment and subdued performance of the REIT instrument.

Below is a summary of the H1’2022 sectorial performance:

| Theme | Thematic Performance and Outlook H1’2022 | Outlook |

| Residential | · The residential sector registered improved performance with average total returns coming in at 5.8%, 0.3% points increase from 5.5% recorded in H1’2021, attributed to an improvement in the residential average y/y price appreciation which came in at 0.9%, 0.3% points higher compared to a price appreciation of 0.6% recorded in H1’2021. | Neutral |

| · We expect total returns to investors to improve supported by improved rental rates and capital appreciation of properties

· For apartments, the best opportunity is investment in areas such as Thindigua, Ruaka, Waiyaki Way, and Kikuyu driven by returns, appreciation as well as state of infrastructure and amenities; for detached units, the best investment opportunity is in areas such as Ruiru, Rosslyn, Juja and Redhill, driven by uptake and the current performance in terms of returns to investors. |

||

| Commercial Office Sector | · In H1’2022, the average rental yield for office spaces in the Nairobi Metropolitan Area (NMA) slightly increased by 0.02% to 7.35%, from 7.33% in FY’2021. This was mainly driven by average rental rates per SQFT which increased by 1.1% to Kshs 95 in the period under review, from Kshs 94 per SQFT in FY’2021 | Neutral (Leaning towards negative) |

| · The performance is however expected to be weighed down by; i) the existing oversupply of space at 6.7 mn SQFT hindering the optimum performance of the sector, ii) slow uptake of office spaces which fuelled by some firms still embracing remote working strategy, and, iii) high cost of living resulting from the high construction costs

· Investment opportunity lies in Gigiri, Westlands, and Karen which offer relatively high returns compared to the market averages |

||

| Retail Sector | · In H1’2022, the average rental yield for retail spaces in the Nairobi Metropolitan Area (NMA) remained the same at 7.8%, when compared to FY’2021 performance | Neutral |

| · We expect performance to be boosted by; i) the rapid expansion drive by local and international retailers, ii) positive demographics, and, iii) increased foreign investments in the country as a result of Kenya being recognized as a regional hub. However, factors such as e-commerce, coupled with the existing oversupply of retail spaces in the market by 3.0 mn SQFT in the Nairobi Metropolitan Area, is expected to continue weighing down the overall performance of the sector

· Investment opportunity in terms of the sub markets performance lies in Kilimani, Karen, and, Westlands which were the best performing nodes in H1’2022 |

||

| Mixed-Use Developments (MUDs) | · Mixed-use developments are expected to continue gaining traction as they offer the live, work and play concept thus convenient for the rising sophisticated middle-income earners with huge demand for exceptional lifestyles | Neutral |

| · We expect MUDs to continue gaining traction supported by relatively higher returns to investors compared to single-theme developments, and a diversified portfolio to investors hence risk spread in the case a thematic sector is performing negatively in the market | ||

| Hospitality | · The hospitality sector recorded mixed performance, with sampled hotels indicating that they were in operation, representing 6.0% points increase to 100.0% in May 2022, from the 94.0% operation rate in May 2021. However, the sector witnessed a decline in the number of international arrivals in Q1’2022 due to the reduced tourism and leisure activities in the hospitality sector, as visitors embarked to their work and studies after the festive season. | Neutral |

| · We expect the hospitality sector bounce back after being one of the most hit by the Covid-19 pandemic, as evidenced by the increased number of operating hotels and bed occupancies coupled with expected increase in tourist arrivals following the World Rally Championship, revision of travel restrictions and the government’s efforts to resolve affairs affecting tourism | ||

| Land Sector | · The land sector in Nairobi Metropolitan Area continues to be a reliable investment avenue and has shown resilience throughout the years. This is evidenced by a 3.1% YoY capital appreciation recorded this quarter | Positive |

| · We expect a similar trend to continue being witnessed throughout the year driven by; i) government’s focus on establishing infrastructure developments thus promoting demand for land, ii) increased focus on the Affordable Housing projects fuelling the need for more land, iii) positive demographics, and, iv) government’s efforts towards ensuring efficient land transactions | ||

| Listed Real Estate | · The Fahari I-REIT closed the quarter at Kshs 6.0 per share, which is 6.3% Year-to-Date (YTD) decline and a 70.0% Inception-to-Date (ITD) decline, from Kshs 6.4 and Kshs 20.0, respectively. We expect the performance of the REITs to continue being weighed down by negative investor sentiments | Neutral |

Email your news TIPS to editor@thesharpdaily.com