For many people, retirement means settling into a more relaxed lifestyle and having time to enjoy things they did not have time for before retirement, such as hobbies, family and recreational activities.

This lifestyle necessitates careful planning in advance through having a solid retirement plan which can either be signing up to a social security fund, enrolling into a pension scheme or investing in other assets like real estate. In Kenya, there are several pension schemes and a National Social Security Fund, NSSF, that allows people to save for retirement.

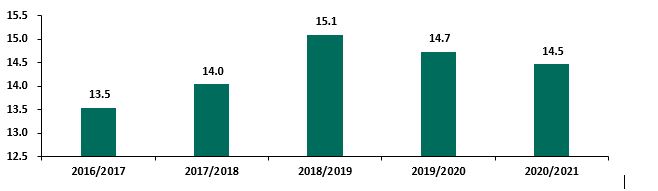

Key to note, NSSF has not gained enough traction overtime attracting a cumulative registered membership of 2.6 million equivalent to 10.8% of the total labour force of 24.1 million persons as of FY’2019/2020 with the members’ contributions growing at a 5-year CAGR of 2.4% to Ksh14.5 billion in FY’2020/2021 from Ksh12.9 billion recorded in FY’2015/2016. The slow traction on membership and contribution is mainly attributable to slow economic growth and high level of unemployment in Kenya making it hard for people to register and make regular contributions to NSSF.

The graph below shows the contribution trend in the last five financial years.

One of the main objectives of NSSF is to provide a source of income to retirees and improve the adequacy of benefits paid out to the beneficiaries. However, according to the Retirement Benefits Authority, Kenya has an Income replacement ratio of 43.0% compared to the recommended ratio of 75.0%, indicating that most retirees in Kenya are likely to remain financially dependent after retiring.

To shed more light on the adequacy of NSSF savings in reducing the dependence of retirees, we compare three scenarios as follows;

- Individual A who relies purely on NSSF contributions (a standard contribution of Kshs 200.0 per month which is matched by the employer),

- Individual B who relies on NSSF but tops up the contribution with Kshs 1,000.0 every month as additional voluntary contributions, and,

- Individual C tops up their NSSF with an additional Kshs 5,000.0. We also assume the following;

| Adequacy of NSSF savings in catering for post-retirement, | |

| Start Working Age (Years) | 25 |

| Retirement Age (Years) | 60 |

| Savings Period (Years) | 35 |

| Assumed Constant Annual Interest Rate | 7.0% |

| Average Salary (Kshs) | 50,000.0 |

| Monthly Pension Contribution (Kshs) | Amount At Maturity (Before Tax) (Kshs) | Number of Year post Retirement one can maintain the same living standard | |

| Individual A | 400.0 | 724,624.0 | 1.7 |

| Individual B | 1,400.0 | 2,536,185.1 | 6.0 |

| Individual C | 5,400.0 | 9,782,428.1 | 23.3 |

Generally, one needs about 70.0% of what they make at the peak of their career to maintain the same standard of living in retirement. By this finding, we can estimate roughly the number of years post-retirement that the three individuals in the table above can live comfortably on their pension money. As per the table above, individual A will have a consistent income for 1.7 years.

Evidently, NSSF savings (as in for Individuals A and B) are not adequate to cater for their post-retirement assuming that they live for more than 15 years, an indication that NSSF does not meet its objective of alleviating poverty and reduction of dependency post-retirement.

Cognizant of the country’s state of the economy, we believe that the government has a lot to do to make NSSF effective in promoting a savings culture and reducing the dependency of retirees. In our view, the government should involve all stakeholders when making NSSF reforms, aggressively educate the public on the importance of saving, enforce compliance measures, and improve operational efficiency to ensure a win-win situation for the government itself, employers and employees. This will see more people sign up for NSSF or other registered Benefits Scheme and consequently reduce poverty in old age.

Email your news TIPS to editor@thesharpdaily.com