Investors at the Nairobi Securities Exchange (NSE) will soon be able to buy and sell listed shares directly using their M-PESA mobile wallets through a new feature known as Ziidi Trader, marking a major shift in how Kenyans access the stock market.

The Ziidi Trader feature, embedded within the M-PESA platform, allows users to trade equities without opening traditional stockbroker accounts. The move is aimed at addressing long standing barriers to market entry, including complex onboarding procedures, minimum funding thresholds, and limited investor awareness.

NSE Chief Executive Frank Mwiti said the introduction of Ziidi Trader is designed to simplify access to the capital markets by leveraging a platform already widely used across the country. “The solution makes coming to market seamless because one of the biggest pain points has always been the process of opening and operating a trading account,” Mwiti said.

How Ziidi Trader works

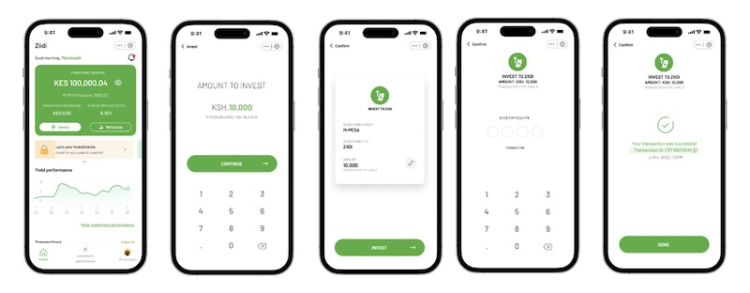

Through Ziidi Trader, investors will place buy and sell orders via an omnibus trading structure supported by licensed market intermediaries. This approach allows multiple investors to trade using pooled accounts while settling transactions instantly through M-PESA, eliminating the need for individual central depository accounts at the entry stage.

Users will be able to browse listed companies, execute trades, track portfolio performance, and receive transaction confirmations directly on their mobile phones. Funds used for trading will be deducted from M-PESA wallets and credited back upon settlement, creating a seamless end to end investment experience.

Expanding retail investor participation

The launch of Ziidi Trader comes at a time when the NSE is actively seeking to increase retail investor participation, which has remained relatively low despite periods of improved market performance. Market data shows that only a small percentage of registered investor accounts engage in regular trading.

Analysts believe integrating share trading into a familiar mobile money platform could significantly broaden participation, particularly among young professionals, micro-enterprise owners, and first-time investors. “Ziidi Trader removes the psychological and operational hurdles that have traditionally discouraged small investors from entering the stock market,” said a Nairobi-based market analyst.

Outlook for 2026

The NSE M-PESA Ziidi Trader integration is expected to roll out fully in early 2026, subject to regulatory approvals. If successfully adopted, the platform could position Kenya as a regional leader in mobile enabled securities trading and redefine how everyday investors participate in wealth creation through the stock market.