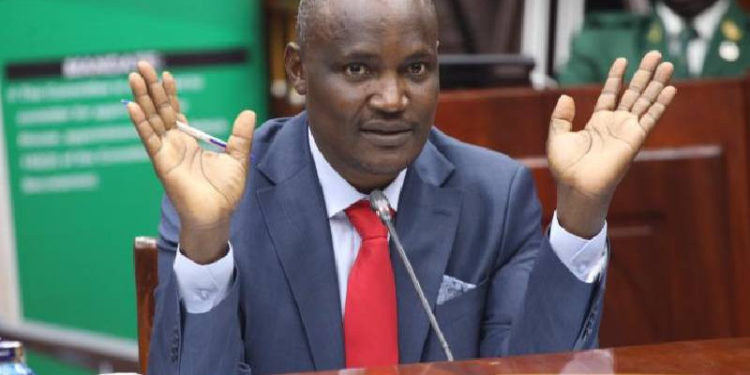

National Treasury Cabinet Secretary John Mbadi has unveiled a five-point strategy aimed at putting more money into the pockets of Kenyans. This comprehensive plan targets the middle class, a group Mbadi describes as the “engine of the economy.” The strategy aims to address concerns over high taxes and expensive loans, which have led to reduced purchasing power for many citizens.

1. Gradual Reduction of PAYE

One of the key pillars of the plan is the gradual reduction of the Pay As You Earn (PAYE) tax. “Lowering PAYE will give working Kenyans more disposable income,” said Mbadi in an interview. This move is expected to ease the financial burden on salaried employees, particularly in light of rising living costs and higher statutory deductions.

2. Lowering Bank Interest Rates

Mbadi also highlighted the need for affordable credit, focusing on lowering bank interest rates. High borrowing costs have stifled entrepreneurship and consumer spending. “Reducing interest rates will spur business growth and encourage investment in various sectors,” he explained.

3. Timely Clearance of Pending Bills

The Treasury has committed to the timely payment of pending bills, particularly to contractors and suppliers who have long complained about delayed government payments. According to Mbadi, “Clearing pending bills is crucial for maintaining cash flow in the private sector and ensuring businesses remain operational.”

4. Expanding Manufacturing and Value Addition

The fourth component of the plan involves expanding the manufacturing sector and promoting value addition in industries. This is seen as a critical step in creating more jobs and boosting economic output. “By strengthening our manufacturing capabilities, we can reduce reliance on imports and support local industries,” noted Mbadi.

5. Comprehensive Tax Review

Lastly, the Treasury aims to review Kenya’s tax policies and collection systems. The goal is to enhance equity and efficiency, ensuring that the tax burden is distributed fairly across all income groups. “A fair and efficient tax system is key to fostering economic growth and social justice,” Mbadi stated.

Since 2022, salaried Kenyans have faced increased deductions, including higher National Social Security Fund (NSSF) contributions and health insurance premiums. Mbadi’s five-point plan seeks to counterbalance these pressures by providing relief and boosting economic resilience.