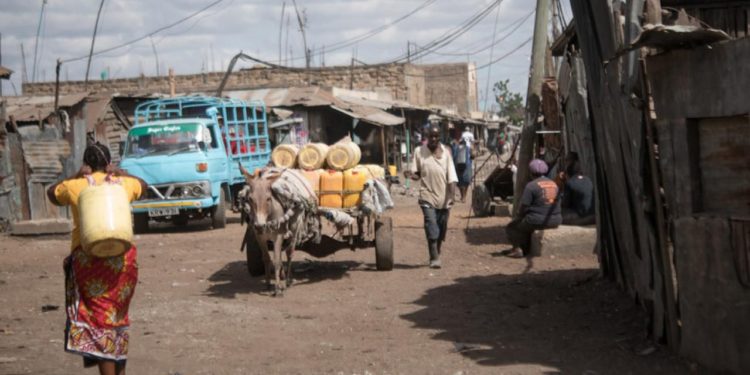

A new 2025 wealth assessment has revealed the widening economic divide in Kenya, showing that just 125 individuals now hold more wealth than more than 42 million Kenyans combined. This means that less than 0.00025% of the population controls more resources than the vast majority of citizens. The findings paint a picture of a country where economic opportunity is unevenly distributed, and where the gains of growth are concentrated among a very small elite. At the same time, millions of households continue to struggle with the rising cost of living, stagnating wages, and limited access to essential services.

The report also shows that in recent years, the top 1% has captured a significant share of newly created wealth while most households have experienced slower income growth. Salary imbalances in the formal sector further highlight the divide, with top corporate executives earning hundreds of times more than ordinary workers. This disparity affects social mobility, making it harder for lower-income families to accumulate savings, invest in education, or build long-term financial security.

The inequality numbers also reflect broader structural challenges facing the country, including high public debt, limited social spending, and an economic environment where many sectors remain vulnerable to shocks. Since 2015, the number of Kenyans slipping into extreme poverty has grown, driven by inflation, unemployment pressures, and the cost of basic needs outpacing household income. With a large portion of the population living on very low daily earnings, even minor economic disruptions can have long-lasting effects.

These conditions make it clear that while national reforms are necessary, individuals also need tools that help them build resilience. Saving consistently, creating financial buffers, and investing in accessible, low-risk options can provide stability in an environment marked by inequality and uncertainty. Many Kenyans increasingly recognize the importance of taking control of their financial journey, even as systemic issues continue to shape the broader landscape.

If you want to start building financial security despite economic inequality, consider the Cytonn Money Market Fund (CMMF). It offers flexibility, liquidity, and a simple way to grow your savings over time.

📞 Call +254 (0) 709 101 200 or 📧 email sales@cytonn.com to get started.