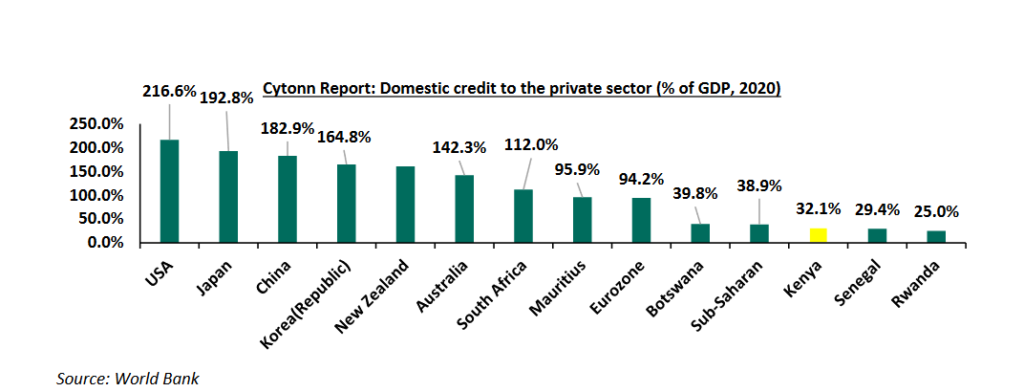

Private sector credit from the banking sector currently stands at Ksh3.3 trillionn, equivalent to approximately 26.1%

of the GDP.

This continues to lag behind other advanced economies such as USA where the Private sector credit

to GDP ratio stood at 216.0% in 2020. Kenya has some work to do to bridge the gap in Private sector credit.

1. Private Sector Credit Growth Performance

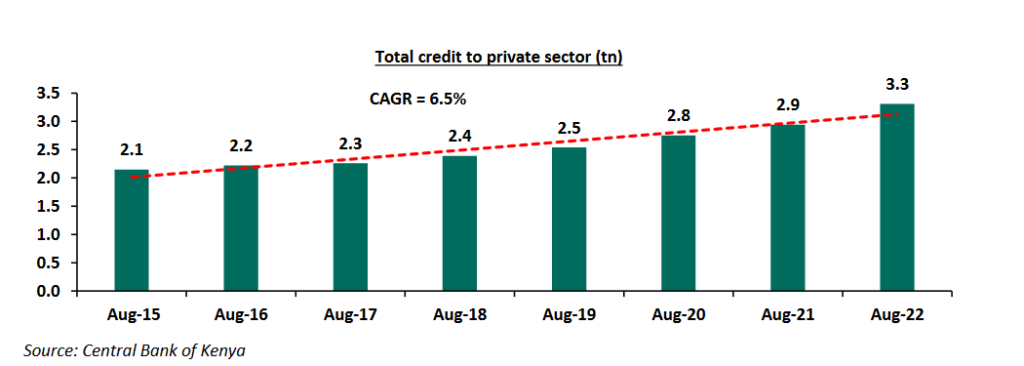

There has been a significant rise in banks’ lending to the private sector over the years, with the total domestic

credit extended to the private sector credit increasing to Ksh3.3 trillion in August 2022.

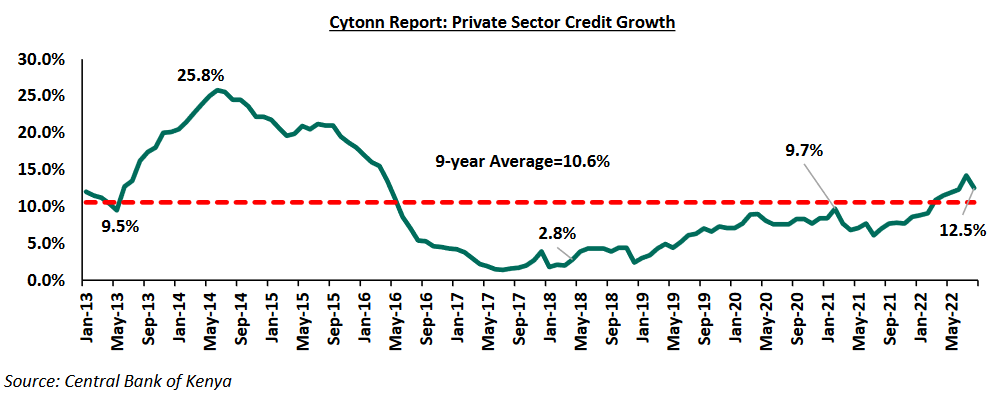

In terms of Private sector credit growth, y/y credit growth as of August 2022 came in at 12.5%, but below the

historical levels, such as 25.8% in June 2014.

The graph below shows the comparison of Kenya’s domestic credit to private sector as a percentage of GDP in

comparison to selected countries.

2. Factors that have influenced Private Sector Credit growth

i) Interest rates – Interest rates affects the supply side of the credit market. For instance, the

capping of interest rates in August 2016 led to low credit growth averaging at 3.7% for the

capping period (August 2016–November 2019) with banks minimizing credit access due to the

small profit margins. Additionally, high interest rates stifle the demand side of the credit

market by increasing the cost of borrowing,

ii) Government domestic borrowing – Commercial banks have continued to hold the highest

proportion of Government domestic debt, coming at 47.5% as at October 2022, due to the

risk–free nature of the investment, effectively crowding out the private sector, which is

considered riskier,

iii) High risk perception by lenders which contributes to high risk premiums – Commercial banks

charge higher interest premiums on the loans borrowed, driven by increased credit risk.

According to the Central Bank of Kenya (CBK), the tightened macroeconomic environment in

2022 has resulted in increased credit risks as banks recorded deteriorating asset quality with

non–performing loans (NPLs) to gross loans ratio coming in at 14.7% in Q2’2022, above the

historical average of 9.7%,

iv) High cost of credit – there are other associated overhead costs incurred during the borrowing

such as bank fees, legal fees and government levies, valuation fees and insurance that are

borne by the borrower, in addition to the interest charged on loans,

v) Over–reliance on the banking sector – The Kenyan private sector is over-dependent on lending

from commercial banks due to the underdevelopment of alternative sources of funding as

currently, the banking sector provides 99.0% of capital to businesses while alternative sources

contribute a combined 1.0%,

vi) Political Risk – The private sector growth in Kenya is susceptible to political tensions

attributable to uncertainties surrounding the business environment as witnesses in the

August 2022 electioneering period where private sector credit demand declined by 1.6% to

Kshs 79.6 bn in Q2’2022 from Kshs 124.1 bn recorded in Q1’2022.

3. Recommendations to enhance Private Sector Credit Growth

The private sector is a significant contributor to the Kenyan GDP. However, credit availability remains a major

hindrance for the sector’s growth.

Below are some of the recommendations that the government can adopt.

i. Enhance financial literacy to the public – The government needs to come up with ways of

sensitizing the public on financial literacy in terms of debt management and budgetary skills, as

well as, an understanding of the different financial instruments and credit within the Kenyan

financial market.

ii. Establish a regulatory framework to enhance consumer protection by enforcing consumer–

centred financial laws, ensuring financial products are transparent and competitive, as well as

handling of consumers complains and issues.

iii. Develop the capital markets to offer alternative sources of capital– The capital market in Kenya

is under–developed as it contributes about 1.0% of total funding to businesses in Kenya.

Developing the capital markets framework will unlock a key financing avenue that businesses can

tap into.

iv. Enhancing oversight on fund initiatives to promote transparency – The government needs to

come up with measures or an independent institution that will oversee the running of funds such

as the Uwezo Fund and Youth Development Fund in terms of timely publication of updates on

amounts disbursed, disclosure of beneficiaries already covered and requirement regulations.

v. Adoption of concessionary loans – Allow the banking sector to provide concessionary loans to

small and medium enterprises with focus on the Agricultural sector as it is the leading contributor

to the GDP and accounts for 70.0% of employment of the rural population.

vi. Enhance Fiscal consolidation – The high borrowing rate by the government is to finance its budget

deficit, however, the government can bridge the deficit gap through expenditure reduction

measures and prioritization of government projects limit capital expenditure to projects which the

economic benefits outweighing cost.

Email your news TIPS to editor@thesharpdaily.com