Kenya is poised to alleviate global financial concerns by initiating an early repayment of a portion of its USD 2.0 billion Eurobond next month, well ahead of the scheduled June due date.

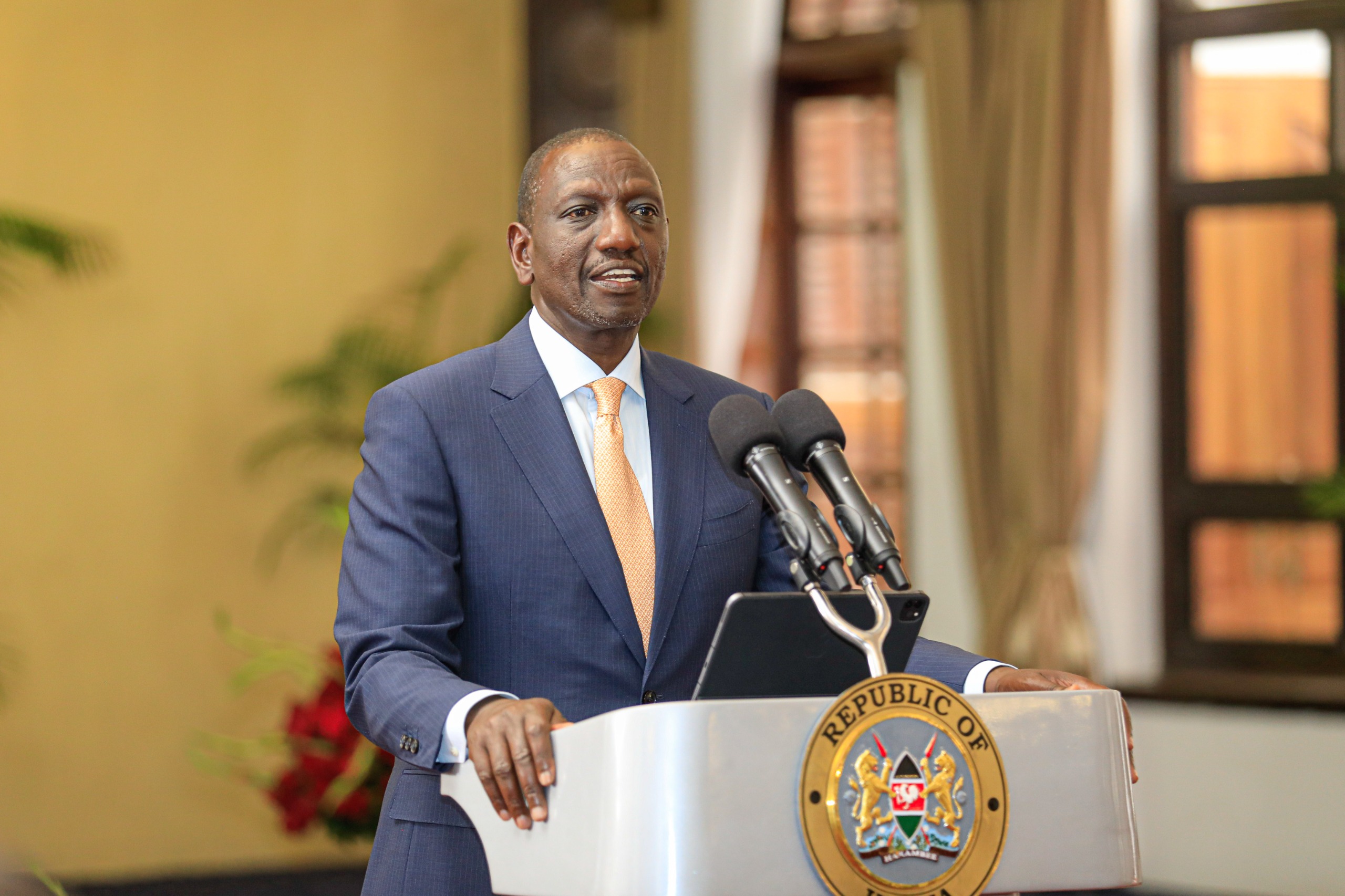

In his State of the Nation address, President William Ruto disclosed the country’s intent to make a USD 300.0 million payment, with the aim of addressing uncertainties in the financial market.

Regarding the USD 2.0 billion maturity in June 2024, the president expressed confidence, stating, “I can now state with confidence that we will and shall pay the debt that has become a source of much concern to citizens, markets, and partners.”

Economist Churchill Ogutu characterizes this move as a “buyback,” involving the repurchase of debt through tender offers, enabling the retirement of some or all securities before maturity.

Initial expectations of a larger repurchase, following President Ruto’s earlier commitment to acquiring at least half of the Eurobond before year-end, may have been tempered by concerns raised by credit rating agencies. The decision to opt for a smaller quantum, such as the USD 300.0 million payment, represents 15.0% of the outstanding debt.

It is noteworthy that in the international markets, the yields on Kenya’s Eurobonds have been on a downward trajectory. The yield on the USD 2.0 billion maturing in June next year declined the most during October, by 3.7 percentage points to 14.6%, down from the 18.3% recorded at the end of September. These declining yields signal improved investor confidence in Kenya’s ability to meet its financial obligations.

Kenya is closely monitored by the international market to observe its approach to debt repayment, given its escalating debt repayments, a weakening currency against major currencies, and a surge in yields that has effectively barred many frontier economies from markets.

The weakening currency has significantly contributed to increased debt repayment costs, as the majority of Kenya’s debt is dollar-denominated. Consequently, the government has allocated at least half of its revenue collection to debt servicing, resulting in a debt service-to-revenue ratio of 64.3% as of September 2023.

This situation has prompted the government to implement additional revenue collection measures, such as revising existing tax rates and introducing new taxes.