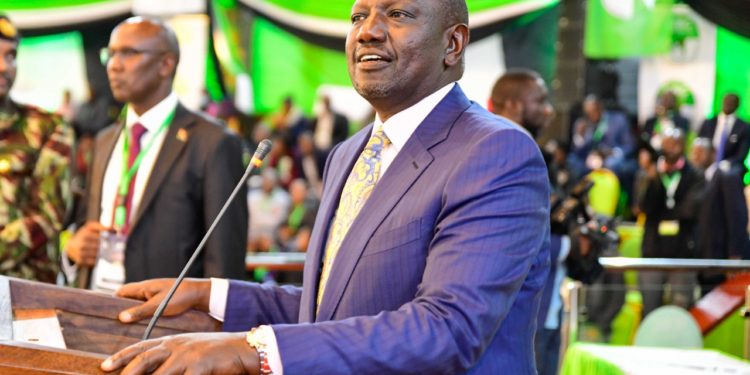

Deputy President William Samoei Ruto has been regarded as one of the political maestros in Kenya, having been declared the President-elect in the August 9, 2022, polls.

Ruto, who vied on a United Democratic Alliance (UDA) ticket, received a total of 7,176,141 votes which is 50.49 percent against his rival Raila Odinga of the Azimio la Umoja-One Kenya Alliance having garnered a total of 6,942,930 equivalent to 48.85 percent as announced by the Independent Electoral and Boundaries Commission Chair (IEBC). The election has been contested at the Supreme Court of Kenya, and upheld, Ruto will become the fifth President of Kenya.

Aside from politics, Ruto is also a businessman who has acquired considerable wealth in the last couple of decades.

Weston Hotel tops the list as one of his valuable assets which have been in the spotlight due to alleged land grabbing claims.

The Kenya Civil Aviation Authority (KCAA) has been trying to regain the land the hotel is built on for years without success. The land was taken from the KCAA, according to the High Court, by two private companies, Priority Limited and Monene Investments, before being transferred to Weston in 2007.

The Prestigious Weston Hotel which sits on a 0.773 hectares piece of land opposite Wilson Airport, is estimated to be worth Ksh2.6 billion

READ: Rigathi Gachagua Loses Ksh200 Million In Case Against State

He also incorporated Matiny Limited in July 1996, a year before he launched a successful first run for the KANU-held Eldoret North MP seat. Matiny Limited which has primarily dealt in Real Estate and hospitality and is also a minority shareholder of Weston is among the most sought-after establishments by Corporates looking to host conferences.

Matiny Limited was one of the companies that profited from City Hall following the issuance of houses in Woodley Estate. In an effort to provide cheap housing for city dwellers, 103 units were constructed; nevertheless, the homes were sold to a number of well-connected individuals who rented them out at high prices. The EACC claims that Matiny Limited was given a home for Ksh20 million.

Its business expansion led to the construction of the Dolphine Hotel in Mombasa estimated to be worth about Ksh600 million. After it came to light that the hotel had allegedly encroached on sea territory while preventing access to a public beach during its development in 2018, it caused an uproar. However, after inspections by the National Environmental Management Authority (NEMA), Mombasa County, and neighbourhood activists, the problems were remedied. Since then, the county and NEMA have approved the hotel’s construction to resume.

William Ruto’s business empires also stretch into the insurance industry where he is a minority shareholder at Amaco with about 50,000 shares through Yegens Farms Limited that deals in Poultry rearing where he previously stated that he rears approximately 200,000 chicken and sells eggs worth Ksh1.5 million each day on his multi-million business. He also added that much of his wealth comes from Safaricom dividends where he holds 400,000 shares.

Read: Mitumba Ban? Here’s What Raila Promised On Textile

Amaco’s clients include both corporates and private individuals. Despite being the subject of numerous insolvency petitions due to its refusal to pay claims, it has recently secured a number of significant contracts from various governmental entities.

He also runs Koilel Farm at his rural home Sugoi, Uasin Gishu County based on a 430-acre plot of land. The business provides the National Cereals and Produce Board (NCPB) with maize. It was one of 12 businesses that Ethics and Anti-corruption Commission looked into in 2018 about suspicious maize sales to NCPB.

Among other properties claimed to be owned by William Ruto and Protected by state security agents include:-

- Murumbi Farm in Transmara,Narok county(395 hectares)

- ADC Laikipia Mutara Ranch(1500 Acres)

- Mata Farm(2537 acres) in Taita Taveta

- Kitengela Gas

- Sentrim 680 Hotel (Ksh 3.1 Billion)

- Orterter Enterprise Limited(Ksh 2.5 Billion)

- Oseng Properties Limited (kshs 1 Billion)

- Karen Home (Kshs 500million)

- Rongai Osere Flats(Kshs 500 Million)

- Uasin Gishu Homestead (Kshs 1.3Billion)

- Media Max Network Limited (87% shares)

Ruto is said to be owning 70 percent of the properties mentioned. His net worth is estimated to be Ksh44 billion.

Email your news TIPS to editor@thesharpdaily.com