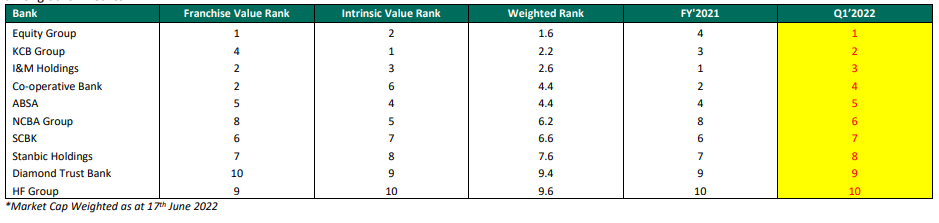

Equity Group Holdings has been ranked as the most attractive bank in Kenya, supported by a strong franchise value and intrinsic value score, according to the Q1’2022 Banking Sector Report by Cytonn Investments.

The franchise score measures the broad and comprehensive business strength of a bank across 13 different metrics, while the intrinsic score measures the investment return potential.

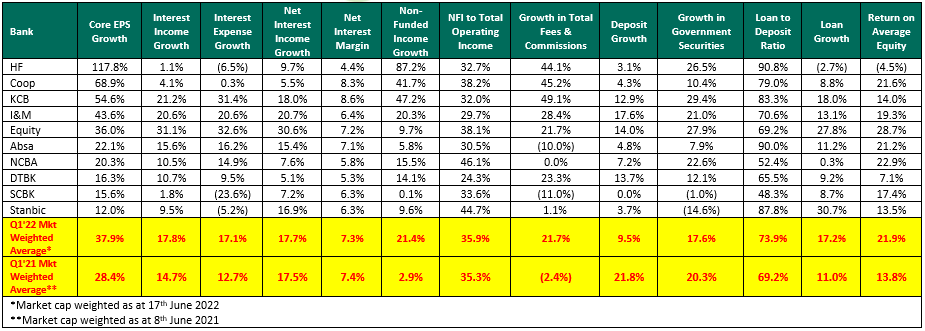

The report, themed “Improved Earnings in an Uncertain Business Environment” analysed the Q1’2022 results for the listed banks. “The Core Earnings per Share (EPS) for the listed banks recorded a weighted growth of 37.9% in Q1’2022, from a weighted growth of 28.4% recorded in Q1’2021, mainly attributable to a 21.4% growth in non-funded income coupled with a 17.7% growth in net interest income.

Read: Peter Kioko Named National Bank of Kenya Acting Managing Director

Additionally, the Asset Quality for the listed banks improved in Q1’2022, with the gross NPL ratio declining by 1.0% point to 12.5%, from 13.5% in Q1’2021.

“We however note that despite this improvement in the asset quality, the NPL ratio remains higher than the 10-year average of 8.1%. The listed banks’ management quality also improved, with the Cost to Income ratio improving by 10.4% points to 53.1%, from 63.5% recorded in Q1’2021, as banks continued to reduce their provisioning levels following the improved business environment during the period”, said Justin N Mwangi, Senior Investment Analyst at Cytonn Investments.

Four key drivers shaped the Banking sector in Q1’2022, namely; Regulation, Regional Expansion through Mergers and Acquisitions, Asset Quality, and Capital Raising.

“In Q1’2022, listed banks continued to borrow from international institutions to not only strengthen their capital position but also boost their ability to lend to the perceived riskier Micro Small and Medium Sized Enterprises (MSMEs) segment in order to support the small businesses in the tough operating environment occasioned by the COVID-19 pandemic. In the period under review, Equity Group received USD 165.0 mn (Kshs 18.6 bn) facility from the International Finance Corporation (IFC) in a bid to raise capital and for onward lending to climate-smart projects and Small and Medium Enterprises (SMEs) in Kenya. As for mergers and acquisitions, there was no much activity in Q1’2022, but we expect to see Kenyan banks continue to diversify into other African regions as they look to reduce their reliance on the Kenyan Market and distribute risks as well. The Key regional acquisition that has occurred recently includes the 83.4% acquisition of Sidian Bank by Access Bank (Kenya) PLC”, said Stellah Swakei, Investment Analyst at Cytonn Investments.

Read: Andrew Bulemi Ukiru Appointed To Cytonn’s Audit, Risk and Compliance Committee

Equity Group’s rank improved to position 1 in Q1’2022 from position 4 in FY’2021 attributable to the improvement in its Net Interest Margin to 7.2%, from the 6.8% recorded in FY’2021, leading to an increase in the bank’s franchise value score, coupled with an improvement in the bank’s Loan to Deposits ratio, which recorded 7.9% points increase to 69.2% from 61.3% recorded in FY’2021. On the other hand, I&M Holdings’ rank declined to position 3 in Q1’2022 from position 1 in FY’2021 attributable to a decline in the bank‘s Gross NPL ratio to 10.0%, from the 9.5% recorded in FY’2021, leading to a decline in the bank’s franchise value score.

The table below ranks banks based on franchise and intrinsic ranking which compares metrics for efficiency, asset quality, diversification, growth, and profitability, among other metrics:

Q1’2022 Listed Banks Earnings and Growth Metrics

The Banks have recorded a weighted average deposit growth of 9.5%, slower than the 21.8% growth recorded in Q1’2021, an indication of reduced investment risk in the business environment.

Read: Nigeria’s Access Bank Buys Centum Stake In Sidian Bank For Ksh4.3 Billion

Interest income grew by 17.8%, compared to a growth of 14.7% recorded in Q1’2021 while the weighted average Yield on Interest Earning Assets (YIEA) increased to 10.0%, from the 9.5% recorded in Q1’2021 for the listed banking sector. On the other hand, the Net Interest Margin (NIM) now stands at 7.3%, 0.1% points lower than the 7.4% recorded in Q1’2021 for the whole listed banking sector.

Non-Funded Income grew by 21.4%, compared to the 2.9% growth recorded in Q1’2022. This can be attributable to the faster growth in the fees and commission which grew by 21.7% compared to a decline of 2.4% in Q1’2021, following the expiry of the waiver on bank charges.

Email your news TIPS to editor@thesharpdaily.com