Understanding Daily yield and Effective annual yield is crucial for anyone involved in investment decisions and investors, particularly in money markets. Daily yield refers to the return on an investment calculated on a daily basis. It is particularly useful for investments where interest compounds daily, such as money market accounts. The daily yield is simply the return of the portfolio without factoring in the benefits of compounding. This provides a snapshot of the investment’s performance on a day-to-day basis.

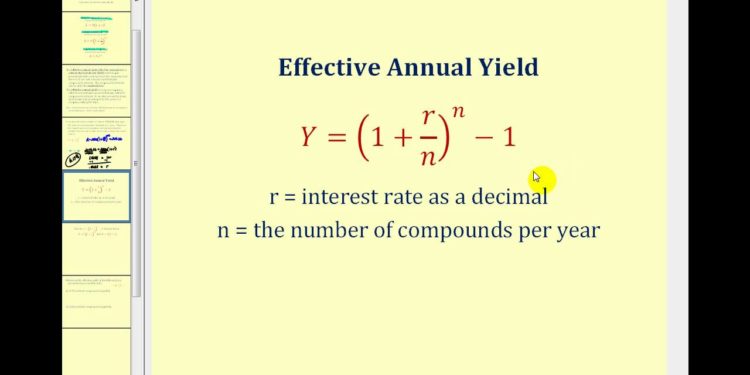

Effective annual yield (EAY), on the other hand, provides a more comprehensive measure of an investment’s performance by taking into account the effects of compounding interest throughout the year. It reflects the actual annual return on the investment. The formula for EAY is ((1+r/n)^n)−1, where r is the daily yield and n is the number of compounding periods per year. By incorporating compounding, EAY offers a true annual return figure that accounts for the growth of the investment over a year.

The key differences between daily yield and effective annual yield lie in their calculation basis and use cases. While daily yield offers a short-term view by not accounting for compounding, EAY provides a long-term perspective by reflecting the compounded returns, making it ideal for comparing investments over extended periods. Understanding these differences helps investors make more informed decisions, particularly when evaluating different investment opportunities or interest-bearing accounts.

For practical application, consider an investment offering a daily yield of 16.5%. The effective annual yield, calculated using daily compounding, would be around 17.97%. This demonstrates how significantly compounding can increase the effective return on an investment compared to the nominal daily yield. This distinction between daily and annual yields is vital for investors aiming to maximize their returns and better understand the performance of their investments.

When considering taxes, it’s essential to understand how withholding tax impacts returns. Assuming a daily yield of 16.5% and an EAY of 17.97%, applying a 15% withholding tax reduces the effective yield. The net EAY can be calculated by multiplying the gross EAY by (1 – tax rate). In this case, the net EAY would be 17.97%×(1−0.15)=15.27%. This reduction illustrates how taxes can significantly affect the actual returns on investments, and it’s crucial for investors to consider tax implications when evaluating potential investments.

In summary, while daily yield is useful for monitoring short-term performance, effective annual yield provides a clearer picture of long-term returns by accounting for compounding. Both metrics are essential for evaluating the true potential of investments, helping investors navigate their financial strategies with greater confidence. By grasping these concepts, investors can better assess their options and make decisions that align with their financial goals. Additionally, understanding the impact of taxes on yields ensures a more accurate evaluation of the net returns from investments.