The Cytonn Money Market Fund had the highest effective annual yield at 10.5 percent against the industry average of 8.9 percent in the first quarter of 2022, new data has shown.

According to the data, Zimele Money Market Fund was second to Cytonn at 9.9 percent followed by Nabo Africa Money Market Fund at 9.7 percent. Sanlam Money Market Fund was ranked fourth at 9.5 percent while Madison Money Market Fund closed the list of top five highest yielding money market funds at 9.3 percent.

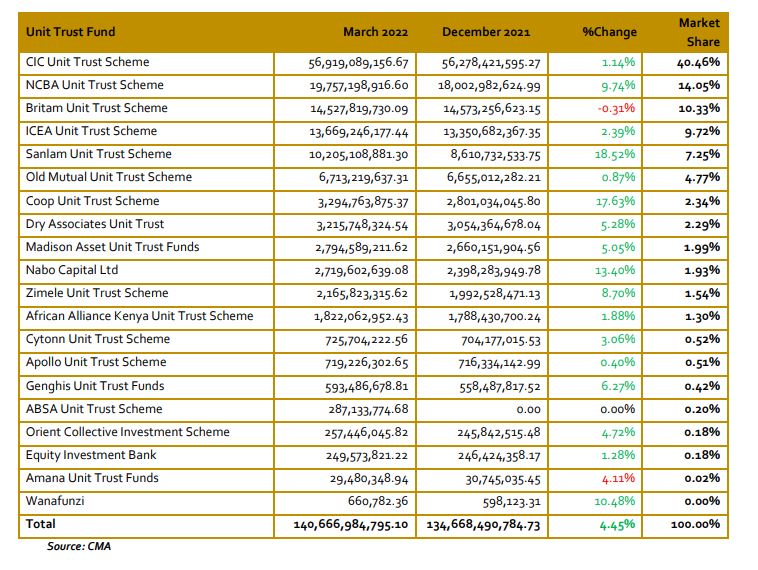

As at March 2022, the total assets under management by the money market funds, otherwise known as collective investment schemes, were Ksh140.67 billion, a 4.45 percent increase from Ksh134.67 billion managed in the quarter ended December 2021.

CIC maintained the lead in managing the highest assets under management of Ksh56.92 billion which represents 40.46 percent of the

total assets under management, followed by NCBA which managed Ksh19.76 billion.

Read: Court Bars CMA From Making Further Defamatory Statements Against Cytonn

Sanlam registered the highest percentage increment of 18.52 percent recording assets under management worth Ksh10.21 billion as at March 2022, up from Ksh8.61 billion recorded in the previous quarter.

For both the Unit Trust Funds and bank deposits, this was slower than the growth recorded as at the end of Q1’2021 of 6.1 percent and 21.8 percent, respectively as the economy was still in the early stages of recovery.

Money market funds in the recent past have gained popularity in Kenya driven by the higher returns they offer compared to the returns on bank deposits and treasury bills. According to the Central Bank of Kenya data, the average deposit rate remained unchanged at 6.5 percent in Q1’2022, as was recorded at the end of FY’2021. During the period under review, the 91-Day T-bill and the average deposit rate continued to offer lower yields at 7.3 percent and 6.5 percent, respectively, compared to the average money market fund yields of 8.9 percent.

GenAfrica Unit Trust Scheme, Natbank Unit Trust Scheme, First Ethical Opportunities Fund, Adam Unit Trust Fund, Masaru Unit Trust Fund, Jaza Unit Trust Fund, Dyer and Blair Unit Trust Scheme, Diaspora Unit Trust Scheme, Standard Investments Bank, and Genghis Specialized Fund remained inactive as at the end of Q1’2022.

Read: Kune Food Closes Shop Months After Raising Ksh100 Million Seed Funding

According to the World Bank data, in well-functioning economies, businesses rely on bank funding for a mere 40.0 percent, with the larger percentage of 60.0 percent coming from the Capital markets. Closer home, the World Bank noted that businesses in Kenya relied on banks for 99.0 percent of their funding while less than 1.0 percent come from the capital markets. Notably, our Mutual Funds/UTFs to GDP ratio at 1.1 percent is still very low compared to an average of 56.3 percent amongst select global markets, indicating that we still have room to improve and enhance our capital markets.

Over the past five years, the unit trust funds’ assets under management have grown at a compound annual growth rate of 20.3 percent to Ksh140.7 billion in Q1’2022, from Ksh55.8 billion recorded in Q1’2017. However, even at Ksh140.7 billion, the industry is dwarfed by asset gatherers such as bank deposits at Ksh4.4 trillion and the pension industry at Ksh1.5 trillion as of the end of 2021.

Email your news TIPS to editor@thesharpdaily.com