The Cytonn Money Market Fund (CMMF) distinguishes itself as a leader in the investment landscape by offering a combination of competitive returns, advanced technology, and accessibility, making it an ideal choice for investors.

One of the key advantages of CMMF is its superior performance. In November 2024, the fund delivered an annualized return of 18.1%, outperforming its benchmark of the 91-day Treasury Bill rate plus one percentage point.

This is achieved through active management of its portfolio, which includes interest-bearing securities, cash, bank deposits, and government securities. By focusing on optimal asset allocation, the fund ensures a balance between high returns and low risk.

CMMF also sets itself apart through its accessibility. With a low initial investment requirement of Kshs 1,000 and additional contributions starting from Kshs 100, it is tailored to cater to a wide range of investors, from beginners to seasoned professionals. The absence of an initial fee further enhances its appeal.

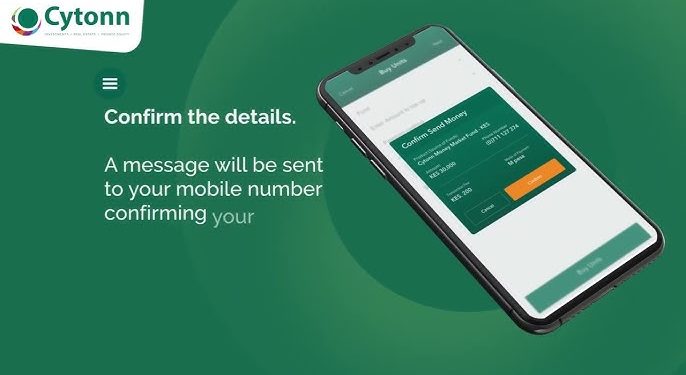

Technology plays a significant role in providing a seamless experience for CMMF investors. The Cytonn app allows users to manage their investments efficiently, offering features such as instant deposits and withdrawals, real-time earnings tracking, and goal-setting tools. This ease of use ensures that investors have full control over their portfolios at any time.

Transparency and reliability are also central to CMMF’s operations. Managed by Cytonn Asset Managers Limited, the fund provides consistent updates and maintains high standards in risk management. Its portfolio strategy actively mitigates credit, duration, and liquidity risks while ensuring compliance with regulatory requirements.