Over the past 10 years, the Pensions industry has recorded tremendous growth in Assets under Management (AUM) having grown by a 10-year compound annual growth rate of 14.5 percent to Ksh1,547.4 billion in December 2021, from Ksh432.8 billion in December 2011. The growth is mainly attributable to increased public awareness of the importance of pensions as well as favorable regulatory reforms. This has seen more people join pension schemes as they strive to grow their retirement pot. Retirement benefits schemes strive to ensure that their members have a sufficient source of income upon retirement. They achieve this by allowing members to make regular contributions during their working years and ensuring that the contributed funds are invested in prudently identified investments that ensure safety and generate returns.

The Retirement Benefits Authority (RBA) through the investment regulations and policies, provides investment guidelines on which asset classes retirement benefits schemes can invest in and the maximum limits. As such, the returns on investment differ from one scheme to another depending on the investments made and also the percentage of funds allocated to each of these investments.

Additionally, each scheme has its own Investment Policy Statement (IPS) that outlines the investment principles and guidelines that are adopted by the Fund Manager on the asset allocation targets as well as the strategic considerations taking into account the scheme’s age liability profile.

Read: Factors To Consider When Investing in Real Estate

Some of the common asset classes that retirement benefits schemes invest in include:

i. Government Securities – These are debt instruments that are issued by the national government to raise funds for government expenditure and to cater to the deficit in the national budget. These securities are classified into two;

a) Treasury Bills – They are short term government securities that mature in one year or less, and,

b) Treasury Bonds – They are medium-term to long-term government securities whose maturity period exceeds one year.

These securities offer fixed interest payments, known as coupons, every 6 months throughout the life of the bond while the principal is paid upon maturity. Treasury bonds are also traded in the secondary market where prices are determined by market movements.

Read: Why Nairobi Presents The Best Investment Opportunities – Report

ii. Quoted equities – These are shares of a company that is listed on the Nairobi Securities Exchange (NSE), such as Safaricom or Equity Group shares, and represent ownership of the company. Retirement benefit schemes earn returns through capital gains when the share price appreciates and dividend payments declared by the company invested in.

iii. Immovable property – These refer to investment in real estate properties such as land and buildings which offer investors the chance to get long-term, stable and attractive returns, that also provide a hedge against inflation. Due to the long-term and illiquidity nature of this asset class, immovable properties are suitable for schemes whose members are not close to retirement age. This enables the schemes to grow their funds faster and the illiquidity of this asset will not be a huge issue as members are not close to the retirement age. Retirement benefits schemes earn from capital appreciation when they sell the property or from the revenue generated from renting or leasing the property.

iv. Guaranteed funds – These are investment products offered by insurance companies that provide a promise of a predetermined minimum rate of return on investments with a maximum allowable limit of 4.0 percent. In cases where the fund’s returns are more than the minimum guaranteed rate, some of the returns on investments are reserved for periods when the market performance is below the minimum guaranteed rate while the remainder is distributed to the pension schemes members subject to the approved issuer’s own discretion.

Read: AfDB Withdraws Multibillion Funding For Nakuru Geothermal Plant Over Moi Presence

v. Fixed Deposits – These are investment instruments offered by banks as well as non-banking financial companies that offer guaranteed interest rates which are paid together with the principal amount at the end of an agreed period of time. Retirement Benefit Schemes invest in Fixed deposits as they are low-risk investments and are highly liquid.

vi. Listed corporate bonds – These are medium-term to long-term debt instruments issued by companies listed in the security exchange markets to cater to the financing of the company’s project. The retirement benefits schemes are paid a pre-established number of interest payments at a fixed rate and also have the option of trading the bonds in the secondary market and gaining from price movements.

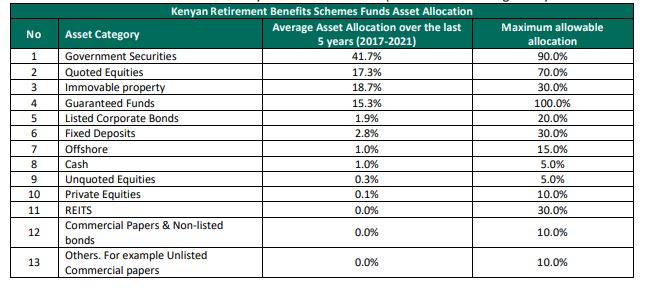

Other investment classes that retirement benefit schemes invest in include Real Estate Investment Trusts (REITs), Unquoted Equities, and offshore investments. The table below shows the historical asset allocation by retirement benefit schemes over the last 5 years as well as the respective maximum regulatory limits:

The above asset classes are the vehicles used by pension schemes to ensure that the members’ funds achieve

attractive returns. Some of the factors that fund managers consider before deciding on which asset class

to invest in include:

a) Capital preservation – The principal objective of Retirement Benefits Schemes is to ensure the safety of members’ contributions.

b) Return on Investment – Retirement Benefit Schemes strive to offer a return to members by investing in income-generating investments. Schemes should always target to deliver returns that are above the inflation rate to ensure positive real returns to members.

Read: Moderna To Establish mRNA Manufacturing Facility In Kenya

c) Diversification – Diversification helps the schemes to manage the risk of negative returns from one asset class by counterbalancing with the positive returns from another asset.

d) Liquidity – Adequate liquidity ensures that the retirement benefits scheme is able to meet its current and future liabilities.

In conclusion, it is important for a fund manager to do thorough research before making a decision on where to invest. This will ensure that the retirement benefit scheme is adequately liquid, compliant with the law and members saving are safe and generate returns. Members should also know the portfolio mix of different Retirement Benefit Schemes before they decide on which scheme to join. This will help one assess the risk profile of the scheme and evaluate whether the risk profile is within one’s threshold of risk tolerance.

Read: 7 Million NHIF Members Risk Losing Cover Over Huduma Namba