William Alonso was an Argentine-born economist and land planner credited with the bid rent theory. The fundamental principle of Alonso’s theory is that rent or land prices are higher around the Central Business District (CBD) and decrease as we move away from the CBD. In this article, we analyze whether Alonso’s theory still holds water in the modern real estate market.

In developing his premise, Alonso made a few assumptions: i) transportation costs are constant throughout the city; i.e., transportation costs are lower when traveling within the CBD than when traveling from the residential district to the CBD because the geographic distance is shorter, ii) the CBD will inherently be the most desirable area for the majority of people, iii) cities will generally have distinct and recognizable districts, notably a centralized business district.

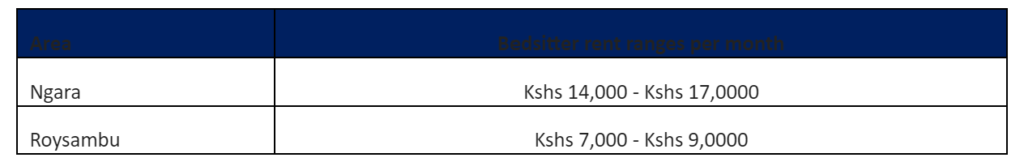

Now, let’s analyze Alonso’s theory using Nairobi City as our CBD. We will compare the rental rates of two areas connected to Nairobi by the Thika Super Highway: Ngara, which is closer to the CBD, and Roysambu, which is further away from the CBD.

Below is the comparison:

From this sample analysis, residents in Ngara are paying relatively higher rents compared to those in Roysambu. According to Alonso’s theory, residents in Ngara enjoy easier accessibility to the CBD, which has more amenities compared to areas further away from the CBD, like Roysambu. This indicates that there is still a correlation between Alonso’s theory and today’s real estate market.

From this sample analysis, residents in Ngara are paying relatively higher rents compared to those in Roysambu. According to Alonso’s theory, residents in Ngara enjoy easier accessibility to the CBD, which has more amenities compared to areas further away from the CBD, like Roysambu. This indicates that there is still a correlation between Alonso’s theory and today’s real estate market.

So, does Alonso’s theory still apply today? As our analysis of Nairobi shows, the core idea that proximity to the CBD increases rent prices still holds true. While the dynamics of modern cities are complex, Alonso’s insight into urban land use remains a valuable tool for understanding real estate trends. Just like in Alonso’s time, the closer you are to the bustling heart of the city, the more you’re likely to pay. Who knew a theory from the past would still be mapping out the future of our cities?