Meta Platforms, Inc. emerged as a key detractor from performance for the Alger Spectra Fund during the fourth quarter of 2025, as investor sentiment shifted in response to the company’s forward-looking cost guidance. While the technology firm delivered strong underlying operating results, market attention centered on management’s outlook for materially higher operating expenses and capital expenditures tied to large-scale investments in artificial intelligence infrastructure.

The fund’s assessment reflects a broader market dynamic in which growth-oriented technology companies face increasing scrutiny over the balance between long-term innovation spending and near-term financial performance. Meta’s accelerated investment in AI infrastructure is part of a wider industry trend as major technology firms race to build computing capacity, data centers, and advanced models capable of supporting next-generation digital services. However, such investments require significant upfront capital, often compressing margins and affecting free cash flow in the short to medium term.

For investors, the concern highlighted during the quarter was not the strategic rationale behind the spending, but its potential impact on earnings visibility. Elevated operating costs and rising capital expenditures can reduce flexibility in cash deployment, influence valuation assumptions, and delay the realization of returns from new technologies. As a result, despite Meta’s strong revenue generation and user engagement metrics, its share price performance reflected caution around forward earnings expectations rather than past execution.

This episode underscores a recurring theme in equity markets: strong fundamentals do not always translate into positive short-term performance when future guidance introduces uncertainty. In sectors driven by rapid technological change, investor sentiment often hinges on how effectively companies communicate the timing and scale of returns on large capital commitments. AI investments, while widely viewed as essential for long-term competitiveness, present unique challenges due to their scale, complexity, and evolving monetization pathways.

The experience of the Alger Spectra Fund also highlights the importance of diversification and liquidity within investment portfolios. Exposure to high-growth equities can offer significant upside, but it also introduces sensitivity to shifts in expectations around costs, capital allocation, and future profitability. Periods of heightened investment spending can lead to volatility even among industry leaders.

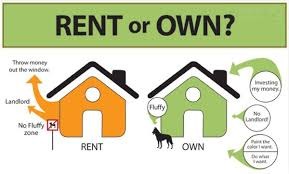

For individual investors, such developments reinforce the value of balancing growth-oriented assets with more stable and liquid investment options. While equities play a critical role in long-term wealth creation, maintaining access to low-risk instruments helps manage uncertainty and preserve capital during periods of market adjustment.

Money market funds provide this balance by offering steady returns, capital preservation, and liquidity, allowing investors to remain flexible while navigating evolving market conditions. They serve as an important foundation for disciplined financial planning, especially when equity markets respond sharply to changes in corporate guidance and capital spending trends.

As financial markets respond to shifting corporate strategies and evolving investment cycles, maintaining a flexible and stable savings strategy is essential. Consider growing your savings with the Cytonn Money Market Fund (CMMF) a transparent, liquid investment option designed to help you earn steady returns while keeping your funds accessible.

📞 Call +254 (0) 709 101 200 or 📧 email sales@cytonn.com to learn more.