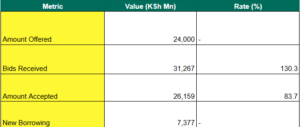

Kenya’s Treasury bills market remained robust in the first auction of 2026, held on 8 January and valued on 12 January. The auction was oversubscribed for the second straight week, with an overall subscription rate of 130.3%, up from 108.0% the previous week. This reflects sustained investor confidence in government securities despite stable yields.

The government offered KSh 24 billion across the three tenors but received bids worth KSh 31.3 billion. It accepted KSh 26.2 billion, resulting in an acceptance rate of 83.7%.

Tenor Performance Breakdown

- 91-day paper (maturing 13 April 2026): Subscription fell to 108.5% from 158.2% last week. Bids reached KSh 4.34 billion, exceeding the KSh 4 billion offered. Yield dipped slightly to 7.728% from 7.729%.

- 182-day paper (maturing 13 July 2026): Subscription declined to 96.1% from 112.9%. Bids totaled KSh 9.61 billion, against the offered amount of KSh 10 billion. Yield stayed flat at 7.8%.

- 364-day paper (maturing 11 January 2027): Demand surged to 173.2% from 83.0%, with bids of KSh 17.32 billion against KSh 10 billion offered. Yield edged down to 9.20% from 9.21%.

Investors clearly favored the longer-dated 364-day paper, shifting away from shorter tenors. This trend may signal expectations of stable or declining interest rates in the near term.

The government raised net new funds of KSh 7.4 billion after redemptions of KSh 18.8 billion.

Yields and Real Returns

With December 2025 inflation steady at 4.5%, T-bills continue to deliver positive real returns:

- 91-day: 3.2% real return

- 182-day: 3.3% real return

- 364-day: 4.7% real return

These returns make T-bills an attractive low-risk option for investors seeking capital preservation and modest income.

Market Implications

The strong oversubscription, especially in the 364-day tenor, points to ample liquidity and investor preference for longer maturities amid a stable macroeconomic environment. Yields have remained range-bound, supported by the Central Bank of Kenya’s cautious monetary stance.

For investors, this auction highlights the continued appeal of government securities in Kenya’s fixed-income market. As we move through 2026, watch for any shifts in inflation or liquidity that could influence future demand.