Festive seasons are often viewed through a social lens, a time of celebration, travel, and generosity. Economically, however, they represent a predictable cycle of expansion and contraction in household and business activity. The surge in spending during festivities, followed by a noticeable slowdown afterward, reflects deeper behavioral and financial dynamics within the economy.

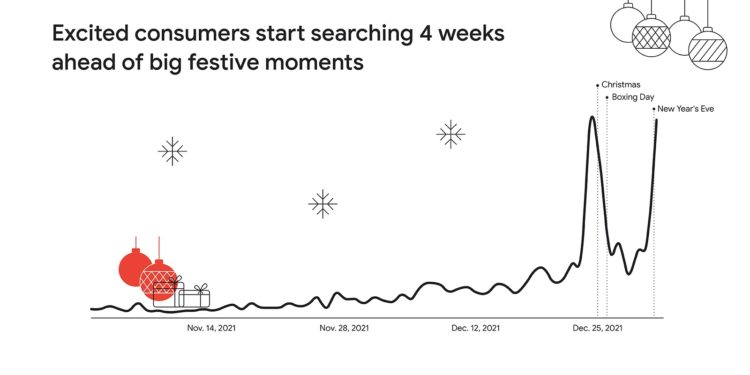

In the run-up to major holidays, consumption rises sharply. Households spend more on food, clothing, transport, entertainment, and travel. Businesses, particularly in retail, hospitality, transport, and the informal sector, experience a short-term boost in revenues. This festive demand surge acts like a temporary stimulus, injecting liquidity into parts of the economy and supporting seasonal employment.

However, much of this spending is not driven by higher incomes but by timing and social expectations. Savings are drawn down, bonuses are consumed rather than invested, and short-term credit is often used to bridge the gap between income and expenditure. For many households, the festive period becomes a planned overspend rather than a reflection of improved financial capacity.

The economic impact becomes more visible once the celebrations end. As households return to regular income cycles, spending contracts. With depleted savings and higher debt obligations, consumers cut back on discretionary purchases. This post festive adjustment is felt most acutely by businesses that benefited during the boom, as demand weakens and cash flows tighten.

Small businesses and informal traders are particularly exposed to this cycle. While festive periods offer an opportunity to earn and rebuild capital, the lack of structured financial planning often means that profits are quickly absorbed into consumption. When demand falls, these businesses face liquidity stress, inventory challenges, and difficulty meeting fixed costs.

At a broader level, the festive cycle influences price dynamics and inflation patterns. Temporary demand pressures can push prices higher, especially for food and transport. Once demand subsides, price growth moderates, contributing to short-term volatility in inflation data. Policymakers and analysts often need to adjust for these seasonal effects when assessing underlying economic trends.

For households and investors, understanding this cycle has practical implications. Festive periods are not only moments of spending but also tests of financial resilience. Those who plan ahead, by smoothing consumption, preserving liquidity, or setting aside post-festive buffers, are better positioned to navigate the slowdown that follows.

Ultimately, festive seasons do not create lasting economic growth on their own. They redistribute spending across time. Recognizing the shift from festive expansion to post-holiday squeezing allows households, businesses, and policymakers to make more informed decisions, turning a predictable cycle into an opportunity for better financial planning rather than recurring strain.

Start your investment journey today with the Cytonn Money Market Fund. Call + 254 (0)709101200 or email sales@cytonn.com