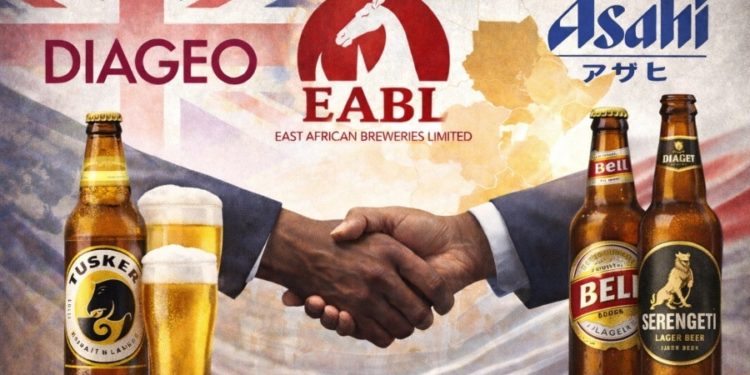

The historic sale of EABL stake to Japan’s Asahi has marked a defining moment for East African Breweries Limited (EABL) and the wider regional beverages industry. In a landmark transaction valued at approximately $2.3 billion (about KSh 297 billion), British drinks giant Diageo agreed to sell its controlling stake in EABL to Asahi Group Holdings of Japan. The deal represents one of the largest foreign acquisitions in East Africa’s consumer goods sector and signals a significant shift in ownership and strategy for one of the region’s most influential companies.

For decades, Diageo has been the dominant shareholder in EABL, overseeing the production and distribution of iconic brands such as Tusker, Guinness, and Bell Lager across Kenya, Uganda, and Tanzania. The decision to exit comes as part of Diageo’s broader global strategy to streamline operations, reduce debt, and refocus on core markets. By contrast, Asahi’s entry reflects a growing appetite by Asian multinationals to expand into high-growth African markets, driven by rising populations, urbanization, and increasing consumer spending.

Under the agreement, Asahi will acquire Diageo’s majority stake, giving the Japanese brewer controlling interest in EABL’s operations across East Africa. Importantly, the transaction also includes arrangements to ensure continuity of globally recognized brands. Long-term licensing and brand partnership agreements are expected to allow EABL to continue brewing and distributing Diageo-owned brands such as Guinness and Johnnie Walker in the region. This continuity is aimed at reassuring consumers, distributors, and investors that day-to-day operations and brand availability will remain stable.

Market reaction to the announcement has been closely watched, particularly on the Nairobi Securities Exchange, where EABL is one of the most valuable listed companies. Analysts view the deal as a vote of confidence in East Africa’s consumer market, with expectations that Asahi may introduce new capital investments, operational efficiencies, and innovation drawn from its global experience. At the same time, regulators in Kenya and neighboring countries are expected to scrutinize the transaction to ensure compliance with competition and public interest requirements before final approval.

Beyond EABL, the historic sale of EABL stake to Japan’s Asahi carries broader implications for the region. It underscores East Africa’s growing attractiveness to global investors and may pave the way for further foreign direct investment in manufacturing and consumer-facing industries. As Asahi takes the helm, industry watchers will be keen to see how the new ownership balances heritage brands with expansion strategies, shaping the next chapter of one of East Africa’s most iconic companies.