Access Bank’s acquisition of National Bank of Kenya (NBK) has received conditional approval from the Competition Authority of Kenya (CAK), with a mandate to retain at least 80% of the target’s workforce for a year post-completion. The CAK’s decision, published on October 30, includes provisions aimed at maintaining employment stability and addressing public interest concerns.

The CAK emphasized the approval was granted “on the condition that Access Bank Plc retains, for a period of one year following completion of the transaction, at least 80% of the target’s current workforce and all Access Bank (Kenya) Plc employees, its local subsidiary.”

The CAK’s decision reflects a cautious approach to mergers and acquisitions, ensuring competition and minimizing negative social impacts. “This approval has been granted based on the finding that the transaction is unlikely to negatively impact competition in the market for financial services,” the statement noted. However, the CAK also acknowledged public concerns around potential job losses, which it addressed through specific employment retention requirements.

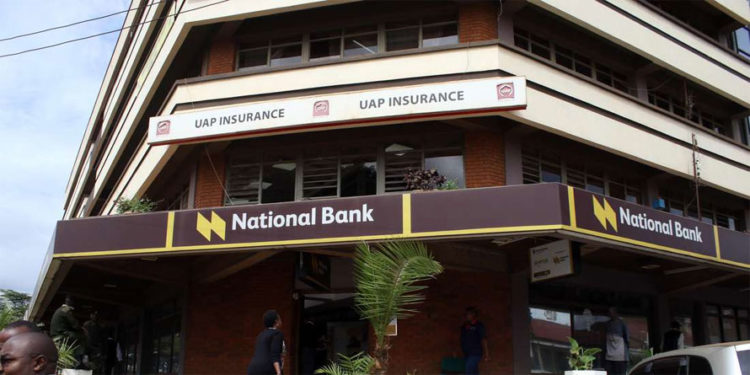

Access Bank, headquartered in Nigeria, operates in Kenya through its local subsidiary, Access Bank (Kenya) Plc, with 23 branches across 12 counties. The bank’s acquisition of NBK, a wholly-owned subsidiary of KCB Group, will involve merging its operations with NBK’s 77 branches nationwide. The transaction includes the acquisition of NBK Bancassurance Intermediary Limited but excludes KCB Asset Management Limited, which has already been transferred back to KCB Group.

In assessing the merger, the CAK identified the “market for the provision of banking services” as the relevant product market and determined the geographic market to be national, given both banks’ operations across Kenya. The regulatory body noted that both entities provide overlapping services, yet maintained that the merger would not substantially lessen competition.