President William Ruto has instructed the National Treasury to revamp the existing taxation structure and eradicate double taxation for Kenyans residing abroad.

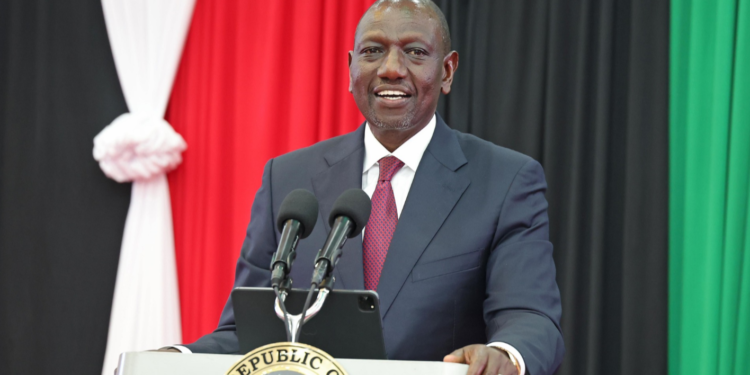

Addressing Kenyan residents in Ghana on Tuesday, April 2, the President emphasized the need for a tax system that does not overly burden the diaspora community.

He recognized that Kenyans abroad are already fulfilling tax obligations in their countries of residence, thus advocating against subjecting them to similar taxes in their home country. Additionally, he disclosed the government’s intention to provide tax credits for diaspora Kenyans as part of the restructuring.

“I have directed our Treasury to conduct a comprehensive review of our taxation framework. We will seek input from the diaspora on areas where improvements can be made. It is our stance that individuals paying taxes in their respective workplaces should not be subjected to duplicate taxation domestically.”

“All individuals need to do is file their returns, indicating their previous tax payments, and we will grant them tax credits to prevent double taxation,” he affirmed.

Furthermore, the President pledged the government’s commitment to collaborate with the diaspora community to establish an equitable taxation system. He encouraged feedback from Kenyans abroad regarding potential enhancements and solutions to tax-related concerns.

“We acknowledge your contributions from abroad and aim to prevent instances of double taxation. Share with us areas of improvement and additional measures we can undertake. Let’s engage in dialogue regarding any tax-related issues,” he remarked.

Moreover, President Ruto unveiled plans for government collaboration with the diaspora to bolster remittance inflows. He highlighted that as of April 2024, remittances totaled approximately USD 3.3 billion, expressing his aspiration to elevate this figure to USD 10 billion within the next five years.

Data from the Central Bank of Kenya (CBK) indicates that the majority of remittances originate from Kenyan expatriates residing in North America and Europe.